If you share your home with a loyal dog, curious cat, or any other cherished pet, you’ve likely wondered: what pet insurance covers dental? Dental health for pets is often invisible until a sudden yelp of pain, a vet’s warning, or a surprising bill jolts you into action. In fact, dental issues are among the most common—and expensive—health problems pets face, yet they’re also some of the least understood when it comes to insurance.

Whether you live in the bustling city of Lagos, suburban London, sunny California, or rural Australia, ensuring your pet’s dental health is crucial for their comfort, longevity, and happiness. Inevitably, questions arise: Does pet insurance help pay for tooth extractions, gum disease, or just accidents? Are routine cleanings or preventive care reimbursed? Can insurance really save you from major out-of-pocket vet costs?

Without clear answers, many pet owners put off coverage or overlook key policy details—leading to stressful, last-minute expenses that can affect both your pet’s health and your hard-earned finances. That’s why understanding exactly what pet insurance covers for dental care, worldwide, is not just about saving money—it’s about giving your furry companion the healthiest, happiest life possible.

In this comprehensive guide, you’ll discover everything you need to know about pet dental coverage:

- How different policies handle dental injuries, disease, and routine care

- What’s excluded, misunderstood, or only available as plan add-ons

- Practical tips to make your pet insurance work harder for dental treatment—wherever you are in the world

- Real-life examples, actionable advice, and a clear breakdown of global differences

By taking a proactive approach to pet dental insurance, you’ll be empowered to protect your pet’s smile, avoid unnecessary expenses, and make well-informed decisions with confidence. Whether you’re a first-time puppy parent or looking to upgrade your aging cat’s health plan, this guide will give you the clarity and peace of mind you deserve.

Why Is Dental Coverage Crucial for Pets?

Veterinarians estimate that over 80% of dogs and 70% of cats will develop dental disease by the age of three. That means the odds are high your pet will eventually need dental care—sometimes involving expensive procedures like extractions, gum surgery, or even root canals. Dental issues don’t just cause bad breath or tooth loss; untreated dental infections can lead to:

- Severe pain and reduced quality of life

- Loss of appetite and malnutrition

- Spread of infection to vital organs (heart, liver, kidneys)

- Increased risk of diabetes and other chronic conditions

How Dental Costs Add Up:

A routine cleaning might cost $100–$400 (USD), but treatment for advanced periodontal disease (such as extractions or oral surgery) can easily exceed $1,000–$2,000. For complex issues, from broken teeth to oral tumors, costs can skyrocket.

This is where pet insurance with dental coverage makes a world of difference—potentially saving you thousands while ensuring your pet gets timely, comprehensive care.

What Pet Insurance Covers Dental – Understanding the Basics

Breaking Down Dental Coverage In Pet Insurance

Not all pet insurance policies are equal when it comes to dental treatment. It’s ESSENTIAL to understand what’s included, what’s excluded, and where you need to pay extra for full protection. Pet dental coverage generally falls into three categories:

Accident-Only Dental Coverage

Accident-only plans typically cover dental injuries resulting from unexpected events:

- Examples of Covered Scenarios:

- Dog breaks a tooth chasing a ball that hits concrete

- Cat fractures a tooth during a fall or collision

- Treatments Covered: X-rays, tooth extractions, medication for infection/pain

- Key Limitations: Does NOT cover dental problems caused by illness (e.g., gum disease, tooth decay), nor preventive cleanings

Real-Life Example

Imagine your playful Golden Retriever chips his tooth biting down too hard on a bone. The vet recommends extraction and antibiotics. An accident-only plan may reimburse you for some or most of the treatment, minus your deductible and co-pay.

Accident and Illness (Comprehensive) Plans

These more robust insurance packages cover:

- Dental Accidents: As detailed above

- Dental Disease: Treatments for periodontal disease, gingivitis, stomatitis, abscesses, oral tumors, and sometimes root canals or tooth reconstructions

- Medications and Diagnostic Costs: Including x-rays, bloodwork, and pain management

Typical Conditions Covered:

- Gingivitis & periodontal disease (the most common dental issue in pets)

- Oral masses, ulcerations, and tumors

- Oral infections or abscesses

- Broken or fractured teeth—regardless of cause (accident or disease)

- Tooth extractions and oral surgeries

- Some plans even cover endodontic (root canal) treatment for vital teeth

IMPORTANT: Many plans require up-to-date preventive dental care (such as annual cleanings or vet exams) for these benefits to apply.

Example

A mature cat develops foul breath and stops eating. Your vet diagnoses advanced gum disease requiring multiple extractions and a dental cleaning. With comprehensive pet dental insurance, you’re reimbursed for much of the $1,500+ bill after deductible—provided your policy had no exclusions for pre-existing conditions and you can prove you’ve maintained regular checkups.

Wellness and Preventive Add-Ons

Standard pet insurance usually does not cover routine dental care, but many providers let you purchase “wellness” or “preventive” add-ons, which reimburse a set annual amount for:

- Professional dental cleanings performed at the vet

- Annual or biannual dental exams

- Possibly fluoride/rinse treatments or dental X-rays

Why Consider It?

Routine cleanings are your best defense against costly, advanced dental disease. These cleanings remove plaque and tartar, preventing the need for extractions or deeper oral surgery later.

Practical Example

You add a $20/month wellness rider, which covers up to $250/year in professional dental cleaning fees. This significantly offsets the annual cost of keeping your pet’s teeth sparkling—and meets the insurer’s requirements for dental illness coverage.

What Exactly Is—And Isn’t—Covered?

To make it concrete, here’s an expanded comparison:

| Dental Treatment | Accident-Only | Accident & Illness | Wellness Add-on |

|---|---|---|---|

| Broken/Fractured Teeth | Yes | Yes | No |

| Tooth Extraction (Accident) | Yes | Yes | No |

| Tooth Extraction (Disease) | No | Yes | Sometimes |

| Periodontal Disease | No | Yes | No |

| Root Canal Treatment | Rarely | Sometimes | No |

| Oral Tumors | No | Sometimes | No |

| Annual Professional Cleaning | No | No | Yes |

| Dental X-rays | Accident only | Disease & Accident | Sometimes |

| At-home Dental Products | No | No | No |

| Cosmetic Dentistry | No | No | No |

| Pre-existing Conditions | No | No | No |

| Hereditary/Congenital Issues | No | Sometimes | No |

Tip: Always check the policy’s fine print—coverage for specifics like root canals, crowns, or advanced surgeries can vary widely.

What Pet Insurance Does NOT Cover For Dental

No dental insurance is absolute. Common exclusions (which apply globally, unless stated otherwise) include:

- Pre-Existing Dental Conditions: Any dental disease or injury noted before the effective date of insurance (or during a waiting period) is almost never covered.

- Ex: If plaque buildup or broken teeth are documented before sign-up, claims won’t be approved.

- Cosmetic Dentistry: Procedures like implants, caps, or veneers are considered elective—insurance won’t pay.

- At-Home Dental Care Products: Toothbrushes, gels, chews, rinses, and diet changes for oral health.

- Failure to Maintain Preventive Dental Care: If you neglect annual cleanings/exams, claims for dental diseases may be refused—even if you’ve paid for coverage.

- Orthodontics: Braces or bite alignment (rare, but sometimes used in show dogs)

- Cleaning for Cosmetic Reasons Only: Routine scale-and-polish for tartar, unless you have a wellness add-on.

- Genetic or Congenital Issues: Some plans (especially in North America) exclude breed-specific hereditary defects like malocclusion or retained baby teeth, though a few UK/Australia providers may allow these under premium cover.

How Pet Dental Insurance Coverage Differs Internationally

Dental Coverage By Country: What Pet Owners Should Know (USA, UK, Australia, Nigeria & More)

United States

- Most leading pet insurance brands (Trupanion, Nationwide, Embrace, Healthy Paws, ASPCA, Figo, Lemonade) offer accident & illness plans—but dental disease coverage details differ sharply.

- Preventive dental care (annual cleaning/exams) is usually required for full dental illness coverage.

- Wellness riders for dental cleanings range from $10–$30/month.

- Check: Some only cover canine/feline teeth—others cover every adult tooth (Fetch pet insurance, for example).

United Kingdom

- Dental coverage in standard policies is less common than in the USA.

- Many UK providers (PAWFECT, Petplan, Agria, ManyPets) require an annual dental check by your vet for illness coverage to be claimable (not just trauma).

- Comprehensive plans may cover injury, disease, and some hereditary conditions.

- Wellness/preventive add-ons are less common but sometimes available.

Australia

- Dental coverage is not standard in most basic plans (Knose, PMP, Bow Wow Meow).

- Many insurers require you to pay extra to include dental, or mandate proof of an annual dental check/clean for full reimbursement.

- Some policies have a per-procedure or annual dental benefit limit (e.g., up to AUS $1,000/year for dental work).

Canada

- Similar to the USA; most policies require evidence of regular dental care.

- Coverage tends to include oral accidents, extractions, and sometimes periodontal disease.

Nigeria & Africa

- Pet insurance is still developing; coverage options are often more limited compared to Western countries.

- Dental illness coverage is rare, but some emerging policies in Nigeria and South Africa (such as through local pet insurance start-ups or international providers expanding into Africa) are beginning to include basic dental accident protection.

- Preventive care is rarely covered except in premium add-ons.

Tips for Every Region

- Always inquire if dental disease is included, or if cover is strictly for accidents/injuries.

- Ask providers to clarify requirements: Is annual vet documentation needed for dental claims?

- Check if there is a waiting period before claims (ranging from 14 to 30 days after enrollment for dental).

Actionable Advice: Choosing the Best Dental Pet Insurance For Your Needs

Step-by-Step Guide to Picking the Right Plan

1. Identify Your Pet’s Risk Profile

- Breed: Some are more prone to dental issues (e.g., miniature schnauzers, dachshunds, persian cats).

- Age: Dental disease risk skyrockets after age 3—and even higher for older pets.

- Lifestyle: Dogs that chew intensely or roam outdoors need more injury protection; indoor cats may need more disease cover.

2. Decide Between Accident-Only vs. Comprehensive Cover

- On a tight budget or for young pets: Accident-only may suffice, but consider the cost of dental disease later in life.

- For long-term security: Accident & Illness plans—including dental disease—offer the broadest protection.

3. Consider Adding a Wellness/Preventive Plan

This is often the only way to offset the cost of annual cleanings, which are both expensive and critical for long-term oral health.

4. Scrutinize Policy Limits and Exclusions

- Is there a per-condition or annual maximum for dental claims?

- Do you need to submit proof of annual cleanings/exams for coverage?

- Is coverage limited to particular teeth or oral treatments?

- Are pre-existing, hereditary, or cosmetic conditions excluded?

5. Compare Providers and Read Reviews

Look beyond price—check:

- Transparency of coverage and exclusions

- Reputation for prompt, fair claim payouts

- Customer service availability (especially if you’re in a non-US market like Nigeria or Australia)

6. Consult Your Vet

Vets often see which insurers honor claims promptly and which offer broadest dental coverage for local conditions. They can help you identify common breed-specific dental risks in your region.

Practical Examples: How Pet Dental Insurance Actually Helps

Extended Real-Life Scenarios from Pet Owners

Example 1 – The Playful Pup

- Situation: Lucy, a one-year-old dog, breaks a molar chewing on a stick at the beach.

- Treatment: Emergency extraction, x-rays, painkillers

- Insurance Coverage: Accident & Illness plan covers 80% after $200 deductible, saving Lucy’s owner $600 out of $900 in vet bills.

Example 2 – The Aging Cat

- Situation: Tigger, a 9-year-old cat, develops chronic halitosis and drools excessively. The vet finds severe gingivitis needing deep cleaning and extraction of 4 teeth.

- Treatment: Cleaning, extractions, antibiotics, follow-up visits

- Insurance Coverage: Because Tigger’s owner had maintained annual dental cleanings (documented by the vet), the insurer covered $1,200 of a $1,500 bill after a modest co-pay.

Example 3 – The Budget-Conscious Family

- Situation: The Smiths, with three rescue pets, add a $25/month wellness rider to their accident & illness coverage, allowing $500/year for dental cleanings.

- Result: Their out-of-pocket cost for each pet’s annual prophy dropped to under $50 after reimbursement—and their insurer noted fewer claims denied for dental issues since they met preventive requirements yearly.

Example 4 – The Expat Experience (Nigeria to UK)

- Situation: Ami moves from Lagos to London with her two cats and is surprised by the stricter requirements UK insurers have for ongoing dental disease coverage.

- Lesson: She learns to schedule and document annual cleanings, switching to a provider (Petplan) that includes dental disease with annual vet proof.

Proactive Tips: How to Maximize Pet Dental Coverage and Oral Health

Prevent Problems, Save Money: Smart Pet Dental Strategies

Start Early—Enroll Before Problems Begin

- Insurance nearly always excludes pre-existing conditions. The moment your pet shows dental issues (even mild tartar), future dental claims for that problem are off-limits.

- Puppies and kittens can halve their lifetime dental costs with early enrollment and consistent preventive care.

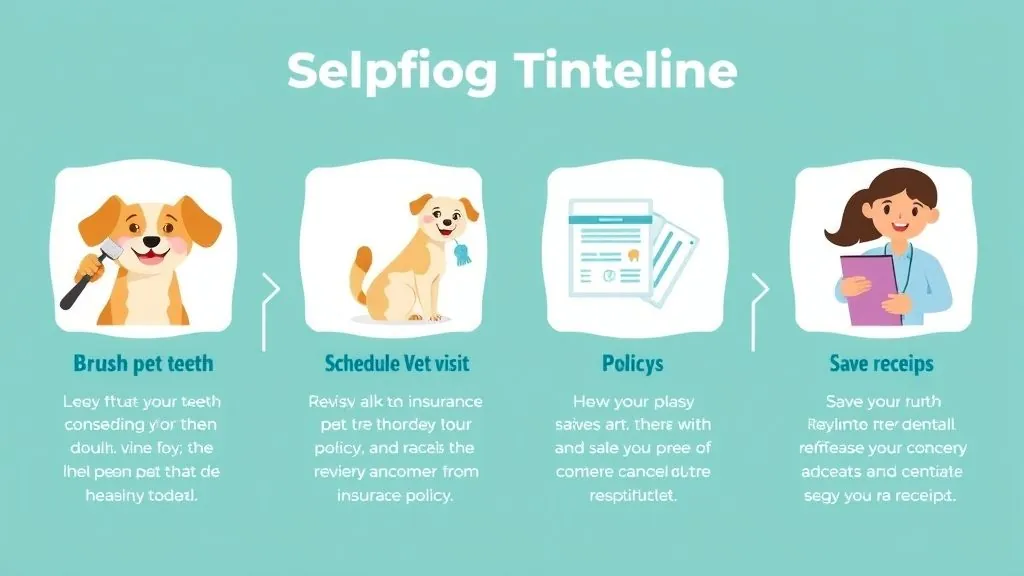

Stay Vigilant About Preventive Care

- Annual Cleanings: Schedule them at your vet, and ask for full dental charting each time—this not only keeps your pet healthy but is often required for claim approval.

- Home Dental Hygiene: Brush your pet’s teeth 3–4 times per week (daily is best); use vet-approved chews or diets.

- Watch for Early Signs: Bleeding gums, bad breath, reluctance to chew, pawing at the mouth, facial swelling—all are warning signals.

Keep Meticulous Records

- Save all invoices, vet notes, and proof of annual cleanings/exams

- For expats or travelers, keep digital copies (Google Drive, Dropbox) in case your insurer needs international verification

Don’t Skip Routine Checkups

- Some insurers now deny claims for dental disease if you’ve missed even a single year of vet exam.

- Set reminders well ahead (your insurer may also offer app alerts).

Choose Providers With Dental Disease Cover

- Avoid “accident-only” unless price is your only criterion.

- If you want advanced dental care covered (such as root canals, crowns, oral tumors), insist on a comprehensive plan—or at least request written proof of what’s included.

Action Steps:

- Assess your pet’s risk profile and dental health needs.

- Shop for pet insurance that fits your geographic and personal needs—don’t just buy the cheapest plan.

- Keep excellent records of every dental vet visit.

- Invest in preventive home care to complement your insurance coverage.

- Re-shop and review your plan annually—your pet’s needs will change with age.

No matter where you live—be it Lagos or London, New York or Sydney—smart, proactive planning for your pet’s dental health ensures more years together, fewer expensive surprises, and plenty of happy, healthy smiles.

Frequently Asked Questions on What Pet Insurance Covers Dental

1. Does pet insurance cover routine teeth cleaning?

- No, unless you buy a wellness add-on. Standard policies everywhere (USA, UK, Nigeria, Australia) exclude cleanings, except as part of comprehensive wellness/preventive packages.

2. Are all my pet’s teeth covered or just certain types?

- Varies by insurer. Some (e.g., Fetch in the US) cover every adult tooth; others may restrict coverage to canine teeth only or exclude molars.

3. Will pet insurance cover dental disease if I don’t get annual checkups?

- Most policies require proof of annual professional dental care for dental illness claims. Skipping even one year could void coverage for related issues.

4. What dental treatments are specifically excluded?

- Pre-existing dental conditions, cosmetic procedures, orthodontics, at-home care, and hereditary issues (unless stated otherwise).

5. Can dental insurance be used for emergency oral surgery?

- Yes, if you have accident or accident & illness coverage. Examples: Tooth knocked out by trauma, fractured jaws, or emergency extractions after a fight or car accident.

6. How are dental claims processed?

- Usually, you pay your vet, submit an itemized bill with receipts and vet notes to your insurer, and are reimbursed after deductibles and co-pay.

- Some insurers in the US/Canada pay the vet directly.

conclusion

Understanding what pet insurance covers dental—and how coverage works from policy to payout—empowers you to make the best choices for your pet’s health and your financial well-being. If you have specific questions about “what pet insurance covers dental” in your country or for your pet’s breed, drop them in the comments below or ask your vet—they’re always ready to help you and your furry loved one smile for years to come!