The golden years of retirement should be a time of peace, relaxation, and financial security. After a lifetime of hard work, the primary goal for most senior citizens is to find a safe and reliable place to invest their hard-earned savings, ensuring a steady stream of income to live comfortably and without worry. The search for security often leads many to trusted, government-backed institutions. This naturally brings up one of the most important financial questions for this stage of life: what is the best investment plan for senior citizens in post office? This question is not just about finding high returns; it’s about finding a sanctuary for your capital, a plan that offers stability, regular payouts, and peace of mind.

This comprehensive guide is dedicated to providing a clear and detailed answer to that very question. We will walk you through the top-rated schemes offered by the post office, breaking down their features, benefits, and suitability for retirees. This exploration will provide you with the knowledge needed to make an informed decision and select the best investment plan for senior citizens in post office that aligns perfectly with your financial goals and lifestyle needs.

Understanding the Appeal of Post Office Schemes

Before we identify the specific plans, it’s important to understand why the post office remains a go-to choice for millions of senior citizens. In a world of volatile markets and complex financial products, post office schemes offer three core advantages:

- Sovereign Guarantee: These schemes are backed by the Government of India, making them one of the safest investment avenues available. The risk of default is virtually zero, which is the number one priority for most retirees.

- Accessibility and Simplicity: With a vast network of branches reaching even the most remote corners of the country, post offices are accessible to everyone. The application processes are straightforward, and the schemes are easy to understand, without the complex jargon of the stock market.

- Regular and Predictable Income: Many post office schemes are specifically designed to provide a fixed, regular income, which is ideal for meeting the day-to-day expenses of retirees who no longer have a monthly salary.

These factors together create a foundation of trust and reliability, making the quest to find the best investment plan for senior citizens in post office a very sensible one.

What is the Best Investment Plan for Senior Citizens in Post Office: The Top Contenders

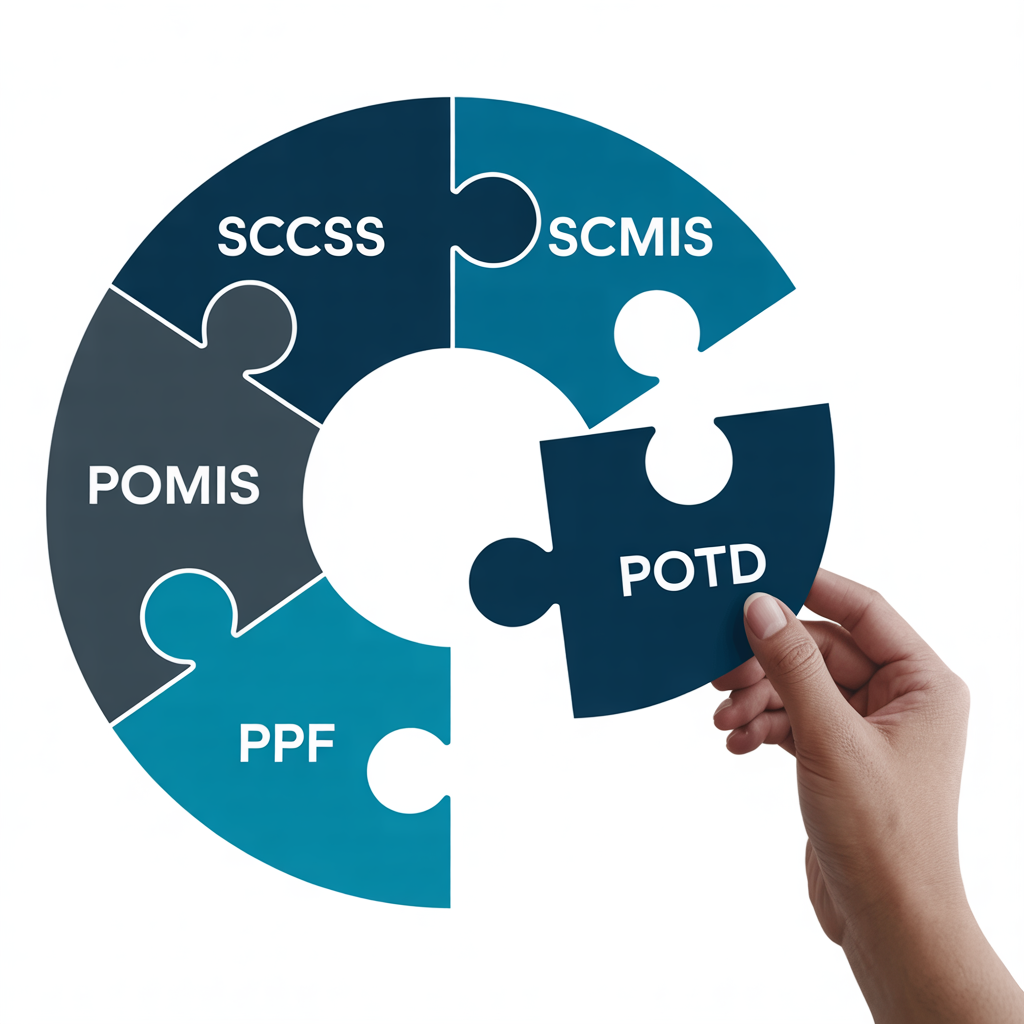

When it comes to answering the question of what is the best investment plan for senior citizens in post office, two schemes consistently stand out from the rest: the Senior Citizen Savings Scheme (SCSS) and the Post Office Monthly Income Scheme (POMIS). While both are excellent, the SCSS is specifically tailored for retirees, often making it the primary choice.

The Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme is, without a doubt, the flagship product designed for retirees. It is purpose-built to provide financial security and a regular income stream to individuals over the age of 60. For most people asking what is the best investment plan for senior citizens in post office, the SCSS is the definitive answer.

Key Features of SCSS:

- Eligibility: The scheme is open to any individual resident of India who is 60 years of age or older. There is a provision for individuals aged 55 to 60 who have retired on superannuation or under a voluntary retirement scheme (VRS) to open an account, provided they do so within one month of receiving their retirement benefits.

- High-Interest Rate: The SCSS consistently offers one of the highest interest rates among all small savings schemes. The rate is reviewed by the government quarterly. For the quarter of April-June 2025, the interest rate is a very attractive 8.2% per annum.

- Investment Limit: An individual can invest a minimum of ₹1,000 and a maximum of ₹30 lakh in the scheme. This high limit allows retirees to invest a significant portion of their retirement corpus. The limit applies to the total amount invested across all SCSS accounts an individual may hold.

- Tenure: The scheme has a fixed maturity period of five years. This provides a stable investment horizon, which is ideal for long-term financial planning in retirement.

- Quarterly Payouts: The interest is paid out on a quarterly basis, providing a regular and predictable cash flow for senior citizens to manage their expenses. The interest is credited on the first working day of April, July, October, and January.

- Extension Facility: After the initial five-year period, the account can be extended for a further block of three years. This extension must be requested within one year of the maturity date. This feature enhances the appeal of the best investment plan for senior citizens in post office.

Why SCSS is often considered the best investment plan for senior citizens in post office:

Its combination of a high, government-guaranteed interest rate, substantial investment limit, and regular quarterly payouts makes it an almost perfect fit for the financial needs of a retiree. The peace of mind offered by the sovereign guarantee cannot be overstated. When safety of capital is the primary concern, the SCSS truly shines as the best investment plan for senior citizens in post office.

The Post Office Monthly Income Scheme (POMIS)

Another excellent option, and a strong contender for the best investment plan for senior citizens in post office, is the Post Office Monthly Income Scheme. As the name suggests, its primary benefit is the provision of a fixed income every single month, which can be incredibly helpful for managing monthly budgets.

Key Features of POMIS:

- Regular Monthly Income: Unlike the SCSS, which pays interest quarterly, the POMIS pays interest monthly. This provides a true “pension-like” income stream that many retirees find very convenient.

- Investment Limits: The maximum investment limit for a single account is ₹9 lakh, and for a joint account, it is ₹15 lakh. While lower than the SCSS, this is still a substantial amount.

- Interest Rate: The interest rate for POMIS is also set by the government quarterly. It is typically slightly lower than the SCSS rate but still very competitive.

- Tenure: The POMIS has a fixed tenure of five years, similar to the SCSS.

- Capital Protection: As a government-backed scheme, the capital invested is completely safe and is returned in full at the end of the five-year tenure. This capital protection is a key feature of what makes it a best investment plan for senior citizens in post office.

| Feature | Senior Citizen Savings Scheme (SCSS) | Post Office Monthly Income Scheme (POMIS) |

|---|---|---|

| Primary Goal | Regular quarterly income with high safety | Fixed monthly income with high safety |

| Eligibility Age | 60+ (or 55+ for certain retirees) | No age limit, open to all adults |

| Interest Rate | Typically the highest among post office schemes (e.g., 8.2% p.a.) | Competitive rate, slightly lower than SCSS (e.g., 7.4% p.a.) |

| Interest Payout | Quarterly | Monthly |

| Max Investment (Single) | ₹30 Lakh | ₹9 Lakh |

| Max Investment (Joint) | ₹30 Lakh (with spouse) | ₹15 Lakh |

| Tenure | 5 years, extendable for 3 more years | 5 years |

| Tax Benefit on Investment | Yes, under Section 80C | No |

Other Viable Post Office Plans for Senior Citizens

While SCSS and POMIS are the top answers to what is the best investment plan for senior citizens in post office, other schemes can also play a valuable role in a diversified retirement portfolio.

Post Office Time Deposit Account (POTD)

Think of the POTD as the post office’s version of a bank Fixed Deposit (FD). It offers a fixed, guaranteed return for a specific tenure.

- Flexibility: It offers various tenure options: 1, 2, 3, and 5 years. This allows for better liquidity planning.

- Interest Rates: The interest rates vary based on the tenure. While calculated quarterly, the interest is paid out annually.

- Tax Benefit: The 5-year POTD qualifies for tax deductions under Section 80C of the Income Tax Act. This makes it a tax-efficient option.

For a senior citizen looking to park a lump sum for a specific period, the 5-year POTD can be a very good choice and a valid part of the discussion about the best investment plan for senior citizens in post office.

Public Provident Fund (PPF)

While the PPF has a long lock-in period of 15 years, it can be an excellent tool for senior citizens who have a longer investment horizon or wish to build a tax-free corpus for their heirs.

- Tax Status: The PPF enjoys an Exempt-Exempt-Exempt (EEE) status. The investment, the interest earned, and the maturity amount are all completely tax-free.

- Investment Window: An individual can invest between ₹500 and ₹1.5 lakh in a financial year.

- Continued Contribution: While a new PPF account cannot be opened by someone over 60, an existing account can be continued indefinitely in blocks of 5 years after the initial 15-year maturity. For someone who has had a PPF account for their working life, continuing it can be a wise move.

For those who prioritize tax efficiency above all, the PPF can be argued as the best investment plan for senior citizens in post office, provided they have an existing account.

How to Choose the Best Investment Plan for Senior Citizens in Post Office for You

The “best” plan is not a one-size-fits-all answer. It depends entirely on your individual needs and financial situation. Here’s how to decide:

- If your primary need is the highest possible regular income and safety: The SCSS is almost certainly your best bet. Its high interest rate and quarterly payouts are designed for this purpose. It is the quintessential answer to what is the best investment plan for senior citizens in post office.

- If you need income every single month to manage your budget: The POMIS is the ideal choice. The monthly payout structure is its standout feature.

- If you want to save on taxes and have a lump sum to invest for 5 years: The 5-year Post Office Time Deposit is a strong contender due to its Section 80C benefits.

- If you want to create a long-term, tax-free nest egg: Continuing an existing Public Provident Fund account is an unbeatable option.

Many savvy senior citizens use a combination of these schemes to build a balanced and secure retirement portfolio. For instance, they might put the maximum amount in SCSS for the high quarterly income and supplement it with POMIS for monthly expenses. This diversification is a smart way to approach finding the best investment plan for senior citizens in post office.

Frequently Asked Questions (FAQs)

Q: What is the single best investment plan for senior citizens in post office?

A: For most retirees seeking the highest safe return and regular income, the Senior Citizen Savings Scheme (SCSS) is generally considered the top choice. However, the ideal plan ultimately depends on your individual needs for income frequency and tax planning.

Q: To create the best investment plan for senior citizens in post office, should I choose just one scheme?

A: Not necessarily. Many seniors find that combining schemes is the most effective approach. For example, you can use the SCSS for its high quarterly returns and the POMIS for steady monthly income. Diversifying across different schemes is often the smartest way to build a robust financial portfolio.

Q: What makes these options the safest and potentially the best investment plan for senior citizens in post office compared to other market options?

A: The primary reason is the sovereign guarantee. Unlike market-linked investments, every scheme offered by the post office is backed by the Government of India. This means your capital is protected, making the risk of loss virtually zero. For retirees prioritizing capital safety, this guarantee is what makes these plans so appealing.

Q: When I invest in what I believe is the best investment plan for senior citizens in post office, is the interest rate locked in?

A: Yes, this is a key benefit. When you open an account in a scheme like SCSS or POMIS, the interest rate that is active on that date is locked in for the entire five-year tenure of your investment. This provides you with a stable and predictable income, protecting you from future rate drops.

Conclusion: Securing Your Financial Future with Confidence

The quest to find the best investment plan for senior citizens in post office is a journey toward securing a peaceful and dignified retirement. The post office, with its government-backed schemes, offers a safe harbor for the funds you have spent a lifetime accumulating.

For the vast majority of retirees, the Senior Citizen Savings Scheme (SCSS) stands out as the premier choice, offering an unparalleled combination of safety, high interest, and regular quarterly income. The Post Office Monthly Income Scheme (POMIS) serves as an excellent alternative, especially for those who prefer the convenience of a monthly payout.

Ultimately, the right strategy may involve a thoughtful mix of these reliable instruments. By carefully evaluating your income needs, risk appetite, and investment horizon, you can confidently select the best investment plan for senior citizens in post office and ensure your golden years are truly golden. The peace of mind that comes from a secure and predictable income stream is the greatest return of all.