Filing a tax return digitally is one of the most impactful financial tasks for anyone with ties to the UK—whether you’re living there full-time, working as an expat, running a side business, managing rental property, or earning freelance income from across the globe. Navigating the UK’s self assessment system for the first time can seem overwhelming, with new digital rules, unfamiliar tax jargon, and the pressure of getting every detail right. Many modern earners have multiple income streams and international connections, making it even more important to know how to file UK tax return online smoothly and securely.

In today’s fast-paced world, doing your taxes online saves you precious time, ensures faster refunds, and enables you to track your filings and payments from anywhere. No more delays with paper forms, long waits for HMRC responses, or guesswork about what you owe. This guide was created for people like you—everyday professionals, entrepreneurs, freelancers, landlords, and global workers—who want clear, actionable advice on every step of the UK online tax return process.

We’ll help you understand why online filing is not just a legal obligation, but also a smart way to manage your finances proactively, avoid penalties, and even optimize your savings. With straightforward explanations, real-life examples, and up-to-date HMRC insights, you’ll learn not only where to begin, but how to get the most from the entire self assessment experience. Whether you’re based in the UK or managing British income from overseas, this comprehensive resource was written to make your tax year easier—and much less stressful.

Who Has to File a UK Tax Return Online?

Understanding your legal tax duties in the UK is the foundation for getting it right from the start. Filing a tax return online might seem daunting, but knowing if you’re required to submit one is half the battle.

Common Scenarios Where Filing is Mandatory

- Self-Employed & Freelancers: If you earned more than £1,000 from self-employment or freelance work in the tax year (6 April – 5 April the following year), HMRC expects a Self Assessment tax return.

- Partners in a Business Partnership: Each partner must file their own personal return, as well as submitting a partnership return for the business.

- Directors of a Limited Company: Most directors need to file unless all income is taxed through PAYE and there is no other untaxed income.

- Landlords: If you earn rental income (over £1,000 annually), whether from residential or commercial UK property, you need to declare this income—even if you don’t live in the UK.

- Those with Foreign Income: Even if you’re a UK non-resident, you might have to file if you have UK property, or receive UK income liable for tax.

- People with Large Savings/Investment Income: If your untaxed income from savings or investments is significant (generally over £10,000), you’ll need to file.

- Individuals Claiming Tax Reliefs or Repayment: Examples include significant charitable donations, pension contributions, or claiming entrepreneur’s relief.

- People Earning Over £100,000: Even if all earnings are taxed under PAYE, you must complete a tax return.

- Parents Claiming Child Benefit: If you or your partner earn more than the High Income Child Benefit Charge (HICBC) threshold, you’re required to file.

- Anyone Specifically Requested by HMRC: This can occur after changes in circumstances, big jumps in income, or a random compliance check.

A Note for Employees

Those solely employed and taxed via PAYE generally don’t need to file unless one of the above applies (e.g. untaxed additional income, employer didn’t deduct enough tax, or claiming certain reliefs).

UK Expatriates and Overseas Income

If you’re living abroad and receive a UK pension, rent out UK property, or have any other UK-source taxable income, Self Assessment still applies to you—even if you’re a non-resident for tax purposes. You can manage your filings digitally via HMRC’s online service from anywhere in the world.

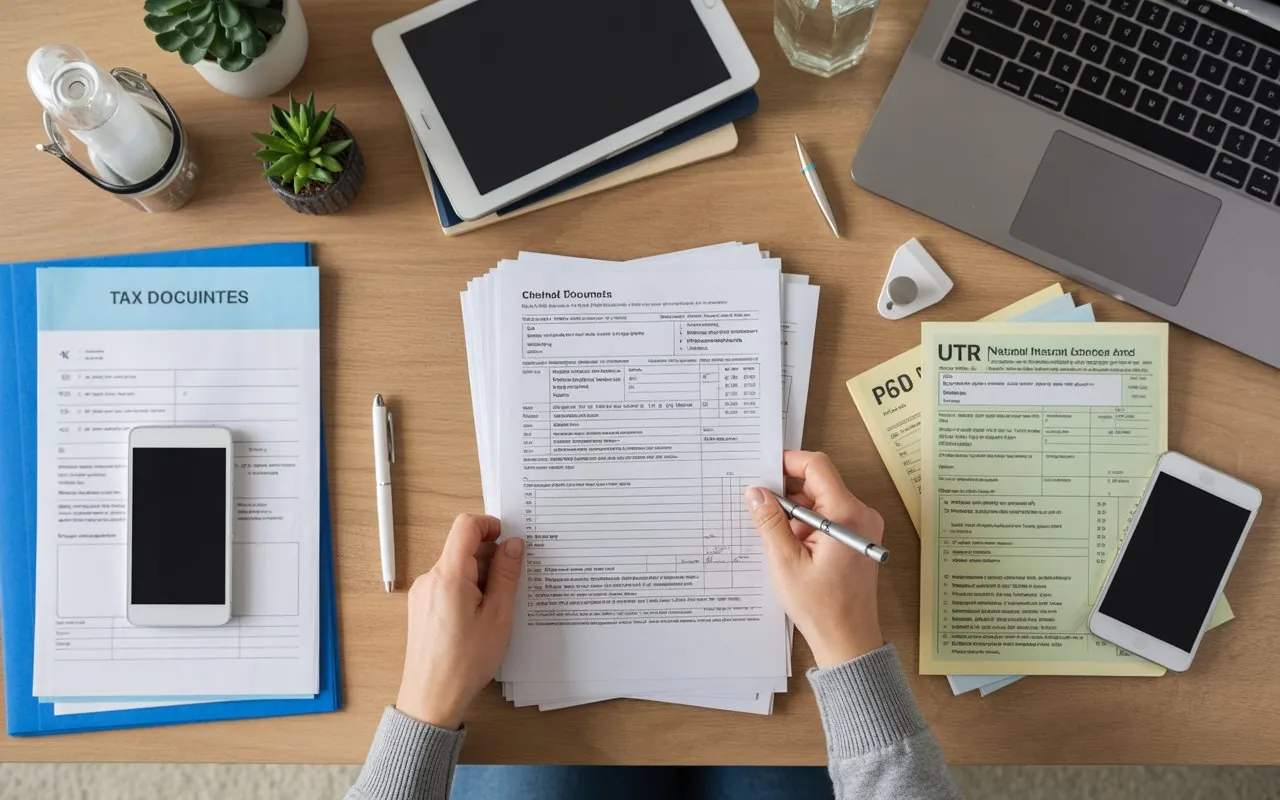

Getting Ready: What to Gather Before Filing Your UK Tax Return Online

Preparation is critical for a smooth filing experience. A little upfront organisation saves hours of back-and-forth when entering numbers online.

Key Documents and Details

- Unique Taxpayer Reference (UTR): A 10-digit number unique to you, issued upon Self Assessment registration.

- Government Gateway login: Your secure ID and password for HMRC’s digital service portal.

- National Insurance Number: Needed for identity and calculation.

- PAYE Forms (For Employees):

- P60: End-of-year earnings summary.

- P45: If you left employment that tax year.

- P11D: Details of company benefits.

- Income Evidence:

- Self-employment: Invoices, receipts, bank statements, sales records, proof of expenses.

- Property: Rental statements, mortgage interest statements, letting agent reports.

- Investments: Dividend vouchers, interest statements, sale/disposal documentation for CGT (Capital Gains Tax).

- Foreign: Overseas payslips, foreign tax credit certificates.

- Tax Reliefs, Deductions, and Allowances:

- Pension contribution certificates.

- Gift Aid donations.

- Student loan statements.

- Documentation to support any other reliefs.

- Previous Tax Year Tax Return (for reference and checks).

- Proof of Residency and UK presence if relevant for split-year claims or non-residency.

Pro Tip: Set Up a Digital Folder

Throughout the tax year, create a digital folder in Google Drive, Dropbox, or your desktop. Drop PDFs or scans of every statement, receipt, and tax-related document into that folder as they arrive. This practice makes online filing efficient and nearly mistake-free.

Registering to Use the UK Online Self Assessment System

If you’re new to UK tax returns, registration is the first hurdle. Do not leave this step until the last minute—delays are common, especially if you live or work abroad or lose your activation code.

1. Registering for Self Assessment

Online:

Start at HMRC’s registration portal

- Choose your taxpayer status (self-employed, landlord, non-resident, etc.).

- Enter your details and submit.

If you were previously registered and you skipped a year, you’ll need to reactivate your profile.

By Post:

In rare cases you might need to fill out a paper form (SA1) if the system requests it, though online is typically faster and more secure.

Government Gateway Activation:

Upon registering, you’ll receive:

- A Unique Taxpayer Reference (UTR) (mailed to your registered address).

- Activation code for your Government Gateway account.

Activation code expires after 28 days—if you miss the deadline, you must request a new one, which can cause filing delays.

2. Setting Up Your Online Account

Follow the emailed or posted instructions to create a secure login/password.

- Choose strong passwords and consider two-factor authentication.

- Input your UTR to link your account.

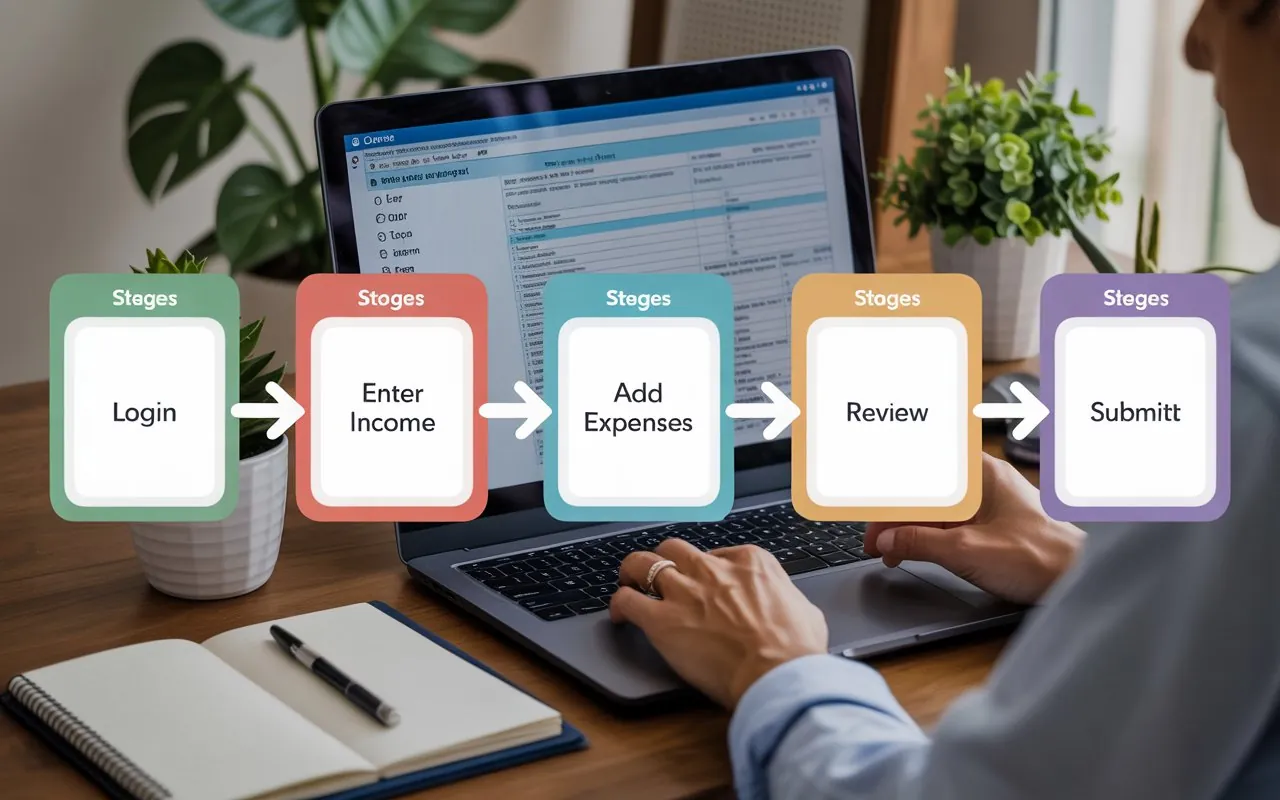

How to File UK Tax Return Online: Step-by-Step Process for 2024/2025

Now, you’re ready to file your UK tax return online. Below, each stage is detailed with examples.

Step 1: Sign in to HMRC Online Services

- Enter your Government Gateway ID, password, and authentication code.

- Go to page gov,uk’s sig in page

- Choose “Self Assessment,” then “File tax return.”

Step 2: Gather Your Data and Complete Each Tax Return Section

The online platform is dynamic—it presents only the sections relevant to you, but you must answer initial questions carefully.

Start with Personal Details

- Name, address, correct National Insurance number, and employment status.

- If you moved or changed jobs, update this.

Employment Income (if applicable)

- Enter details from your P60/P45.

- If you worked multiple jobs, add each one.

- Enter any taxable benefits-in-kind from P11D (company car, medical insurance, etc.).

Example:

Anna had two jobs in the same year; she enters each employer’s details, gross salary, PAYE tax already deducted, and any company car benefits.

Self-Employment: Business Income and Expenses

- Use the “Additional Information” section: SA103S (short form if annual turnover under £85,000), or SA103F (full) if higher or more complex.

- Enter gross income (total sales or fees).

- List allowable expenses (see list below).

Expenses you might claim:

- Office supplies, equipment, advertising, Internet, business travel, insurance, bank charges.

- Home office costs (portion of rent, utilities, council tax).

Example:

Tom is a freelance programmer. Gross earnings: £32,000. Expenses:

- Laptop: £1,200

- Internet: £300

- Business travel: £400

- Home office (15% of rent): £1,000

He enters these, reducing taxable profit.

Rental Income from Property

- Choose the “UK property” section (SA105).

- Report all rental income and deductible expenses: letting agent fees, mortgage interest, repairs, insurance, utility bills (if paid on behalf of tenant).

Example:

Sarah earned £14,000 rental income. Expenses:

- Mortgage interest: £2,500

- Repairs: £900

- Letting agent fees: £1,200

Her taxable rental income is £9,400.

Savings, Investments, and Dividends

- Enter interest (from all UK and overseas accounts).

- Report dividend income and capital gains on sales of shares or other assets.

Foreign Income

- Use the “Foreign” section for declaring earnings from abroad, foreign bank interest, or employment.

- Enter any foreign tax credits, if eligible, to avoid double taxation.

Other Sections

- Self-employment support grants

- Pension income

- Student loan repayments

- Gift Aid, pensions, and other tax reliefs

Deductions, Tax Reliefs and Repayments

Maximise deductions:

- Pension scheme contributions (private or company)

- Donations with Gift Aid (tax-effective giving)

- Work-related expenses not reimbursed by employer

Record evidence for these in case HMRC later requests proof.

Step 3: Review, Validate, and Submit

- The HMRC system does real-time checks; if something looks off, it prompts you to correct.

- Declare you have reviewed info truthfully; sign your digital declaration.

- Click “Submit.”

You get an immediate submission reference and onscreen confirmation. Download and keep a PDF copy of the full return for your records.

Step 4: Pay Your Tax Owed

After you submit, HMRC displays your calculated tax bill:

- Includes national insurance for self-employed

- Shows payment deadlines (usually 31 January for prior tax year)

- DETAILS of how to pay (bank transfer, Direct Debit, card, or via PAYE, if possible)

- Early payment is possible—you don’t have to wait until January deadline

If you’re due a refund:

Ensure bank details are up to date on your HMRC account for digital payout.

Advanced Tips for Filing UK Tax Returns Online

1. File Early (and Why It Helps)

- Know your bill earlier so you can budget.

- Resolve errors and gather missing evidence without pressure.

- Minimise risk of late penalties due to technical errors or postal delays.

2. Automate and Organise Records

Using simple accounting software like FreeAgent, QuickBooks, or even a smart spreadsheet helps track income and expenses as you go. Many apps now integrate directly to HMRC’s Making Tax Digital (MTD) system for easier returns in future.

3. Double-Check Common Pitfalls

- Did you include all your bank interest, not just from your main account? HMRC gets reports from UK banks.

- Claimed only expenses genuinely related to production of income—personal spending doesn’t qualify.

- If married or partnered, check if tax-free allowances (like Marriage Allowance) apply.

4. Plan for Payments on Account

If your tax liability is over £1,000 and less than 80% is already paid via PAYE, you may need “Payments on Account”—advance payments for next year’s bill. The system alerts you. Budget accordingly.

5. Fixing Errors After Submission

Mistakes happen! You can amend your online Self Assessment return up to 12 months after the filing deadline by logging in and editing the appropriate tax return.

Common Mistakes on UK Online Tax Returns—and How to Avoid Them

1. Missing Income

File for every income stream—even secondary jobs, side gigs, eBay sales, or overseas interest. Cross-check your bank statements and any official HMRC notices.

2. Incorrect or Missing UTR

If you type in the wrong Unique Taxpayer Reference, your return may not register. Always copy from official correspondence.

3. Over- or Under-Claiming Expenses

HMRC can ask to see receipts or evidence for any claims.

- Over-claiming (adding personal expenses as deductions) risks hefty fines.

- Under-claiming means you pay more tax than necessary.

4. Late Submission

The window to file is from 6 April to 31 January the following year. The penalty for missing the deadline is £100 instantly, even if you owe no tax. Further delays trigger rising penalties (daily charges, percentage of total owed, plus interest).

5. Failing to Pay in Time

You must pay by 31 January. Late payments attract interest and additional penalties. Pay early to avoid bank processing delays.

6. Inadequate Record-keeping

If you can’t provide supporting documents for income or claims, HMRC may adjust your bill (and fine you). Store records for at least five years after the submission deadline.

Real-World Example: Freelancers with Global Clients

Let’s walk through a practical, real-world scenario for clarity.

Julie is a British citizen living in Spain but still freelances for UK-based companies and global clients. Here’s how she files:

- Registers for Self Assessment online and receives her Unique Taxpayer Reference at her Spanish address.

- Sets up her Government Gateway profile with international verification.

- Keeps digital records of all invoicing, payments received, and receipts for business spending—much of it paid via PayPal and Stripe—making sure to download monthly summaries.

- At tax year-end, logs in to HMRC, enters:

- PAYE income from a short-term UK contract (P45)

- Freelance income, itemised with expenses for software subscriptions, travel for UK projects, and new equipment

- Foreign bank interest earned and foreign tax already paid (entering this in the Foreign Income section and claiming relief to avoid double taxation)

- Claims expenses for home Internet, office rent, foreign payment fees.

- After submission, reviews the calculated tax bill, pays via international transfer using his Spanish bank account.

- Amends his return a month later when he finds a missing invoice, updating the totals and downloading the new confirmation.

Insider Advice: How to File UK Tax Return Online More Easily

- Use Checklists: Many professional accountants use their own year-by-year checklist for each client. Adopting this habit at home means nothing is missed.

- Turn on HMRC Email Reminders: Receive deadline warnings and important updates to your inbox.

- Reach Out for Help: HMRC offers live chat, detailed help pages, and helplines tailored for expats, landlords, and business owners.

- Don’t Panic About Changes: Each year’s software is updated for new rules; just answer the on-screen questions honestly and you’ll be routed to the right forms.

- Plan for Next Year: If your business or property income is growing, put aside tax savings as you go—especially with quarterly updates soon mandatory under Making Tax Digital (MTD).

Key takeaways:

- Start early and get your digital credentials in order, especially if you’re overseas, new to Self Assessment, or have moved recently.

- Organise your income and expenditure records as you go for maximum speed and accuracy.

- Use the HMRC online system or approved software—never send financial information via email or unofficial channels.

- Take your time. Filing online gives you the flexibility to save, come back later, and review before pressing submit.

Frequently Asked Questions on Filing UK Tax Returns Online

Can I file my UK tax return online while living overseas?

Absolutely! UK Self Assessment is designed to be accessible globally. Expatriates or non-residents can access their digital account and submit from any country (just ensure you can receive post at your registered correspondence address for official codes and notices).

What’s the penalty if I file late?

- Instant £100 penalty for being late—even if you owe no tax.

- After 3 months: £10/day (up to £900).

- After 6 months: Additional £300 or 5% of the tax owed.

- After 12 months: Another £300/5% and possible additional fines in serious cases.

Can I file a joint return with my spouse?

No, each taxpayer has their own UTR and must file separately. However, some allowances (like Marriage Allowance or Blind Person’s Allowance) can be transferred or claimed by the eligible partner.

Can I use third-party software or must I use the HMRC website directly?

Third-party commercial tax software (like TaxCalc or FreeAgent) can file returns electronically and is sometimes easier for people with complex affairs. The process and deadlines remain the same.

What happens if I realise after filing I made a mistake or missed something?

You can log in and amend your online return within 12 months of the 31 January deadline. HMRC understands mistakes occur; they care that you rectify them.

conclusion

Learning how to file UK tax return online demystifies a process that, while complex at first glance, is entirely manageable with the right preparation. By focusing on preparation and educating yourself about HMRC’s online process, you’ll meet or beat your tax deadlines, reduce stress, and often save money. Remember, every pound you legally save by claiming rightful expenses is a pound you keep in your pocket.