Receiving unemployment benefits can be a crucial lifeline during a period of job loss, providing the financial stability needed to cover essential expenses while you search for new work. However, a common point of confusion and surprise for many recipients is the tax implications of this income. A critical question that arises is, what is the federal tax rate on unemployment benefits? The answer is not as straightforward as a single percentage. Unlike a simple sales tax, the way this income is taxed depends on your overall financial picture for the year.

This guide is designed to be your definitive resource, clarifying exactly how the U.S. federal government treats unemployment compensation for tax purposes. We will break down the rules, explain your options for managing your tax liability, and provide practical examples to help you navigate this complex topic. Understanding the answer to what is the federal tax rate on unemployment benefits is essential for avoiding a surprise tax bill come filing season. Let’s explore the details so you can handle your taxes with confidence and peace of mind.

The Core Principle: How the IRS Views Unemployment Income

The first and most important thing to understand is that the Internal Revenue Service (IRS) considers unemployment benefits to be a form of taxable income. This means that the money you receive from your state unemployment agency is not tax-free. It must be reported on your federal income tax return and is subject to taxation just like wages from a job, freelance income, or interest earned from a savings account.

This often surprises people because the benefits feel like a form of assistance, but from a tax perspective, they are treated as a replacement for lost wages. Therefore, the income is included in your overall gross income for the year. This directly impacts the central question of what is the federal tax rate on unemployment benefits, because there isn’t a special, separate rate for this type of income. Instead, it is taxed at your marginal tax rate, which is determined by your total income and filing status.

The key takeaway is that you cannot simply ignore your unemployment compensation when it comes to taxes. Failing to account for it can lead to a significant tax liability, potential underpayment penalties, and interest charges. Knowing that it is taxable is the foundational step before we can determine what is the federal tax rate on unemployment benefits for your specific situation.

Understanding Marginal Tax Rates: The Real Answer to “What is the Federal Tax Rate on Unemployment Benefits?”

This is where we get to the heart of the matter. There is no single, flat federal tax rate on unemployment benefits. The amount of tax you will pay is determined by the U.S. progressive tax system, which uses marginal tax brackets.

How Tax Brackets Work

The U.S. federal income tax system is “progressive,” which means that people with higher taxable incomes are subject to higher tax rates. The system is divided into several income ranges, known as tax brackets, each with its own corresponding tax rate.

For example, for the 2024 tax year, the brackets for a single filer are:

- 10% on income up to $11,600

- 12% on income over $11,600 up to $47,150

- 22% on income over $47,150 up to $100,525

- And so on, with higher brackets for higher income levels.

It’s important to note that this is a marginal system. This means you don’t pay a single rate on all of your income. You only pay the rate for the portion of your income that falls within that specific bracket.

How Unemployment Benefits Fit In

Your unemployment benefits are added to all of your other sources of income for the year (such as wages from a job you had for part of the year, freelance income, investment income, etc.) to determine your total taxable income. This total amount is what determines which tax brackets your income falls into.

Therefore, the answer to what is the federal tax rate on unemployment benefits is that the benefits will be taxed at the highest marginal rate that your total income pushes you into. For example, if your total taxable income, including your unemployment benefits, places you in the 22% tax bracket, then your unemployment income is effectively being taxed at 22%. If you remain in the 12% bracket, it will be taxed at 12%. The specific answer to what is the federal tax rate on unemployment benefits depends entirely on your unique financial situation for the entire year.

This is why it is impossible to state a single universal rate. The question what is the federal tax rate on unemployment benefits is personal to each taxpayer.

Practical Management: How to Pay Taxes on Your Unemployment Benefits

Now that you understand that your unemployment benefits are taxable, the next logical question is how to manage and pay those taxes to avoid a large bill at the end of the year. You have two primary options for this.

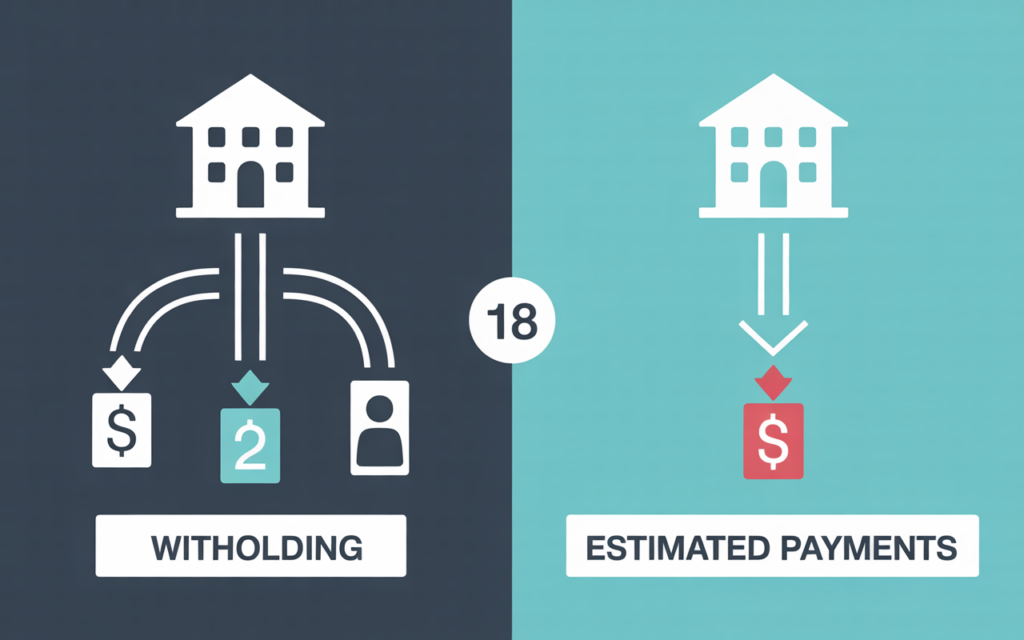

Option 1: Voluntary Withholding

This is often the simplest and most direct way to handle the tax liability. You can choose to have federal income tax withheld from your unemployment payments directly. The payer of your benefits (your state unemployment agency) gives you this option.

- How it Works: You can elect to have a flat 10% of your benefits withheld for federal taxes. To do this, you typically need to fill out IRS Form W-4V, Voluntary Withholding Request, and submit it to your state agency. Many states also offer an online option to set this up when you first apply for benefits or through your online portal.

- The Pros: This “pay-as-you-go” method helps you cover your tax liability throughout the year, preventing a large, unexpected tax bill when you file your return. It automates the process so you don’t have to worry about setting money aside.

- The Cons: The flat 10% rate may not be enough to cover your total tax liability, especially if your other income pushes you into a higher tax bracket (like the 12%, 22%, or higher). Conversely, if 10% is more than your actual tax rate, you will have overpaid and will have to wait for a refund. Despite this, for many, it is a practical way to address the question of what is the federal tax rate on unemployment benefits proactively. It is a crucial choice when considering what is the federal tax rate on unemployment benefits.

Option 2: Making Estimated Tax Payments

If you choose not to have taxes withheld, or if you believe the 10% withholding will not be sufficient, your other option is to make quarterly estimated tax payments to the IRS.

- How it Works: You are responsible for calculating your expected tax liability for the year and sending payments to the IRS four times a year (typically in April, June, September, and January). You can do this using Form 1040-ES, Estimated Tax for Individuals.

- The Pros: This method gives you more control over your money. You can hold onto the funds until the payment due date. It also allows you to be more precise, adjusting your payments based on your total income picture, which is especially helpful if you have fluctuating income from other sources, like freelancing. It provides a more tailored answer to what is the federal tax rate on unemployment benefits for your situation.

- The Cons: This option requires more discipline and planning. You must remember to make the payments on time to avoid underpayment penalties. It also requires you to do the calculations yourself, which can be more complex than simple withholding. When deciding on this method, the question of what is the federal tax rate on unemployment benefits becomes a more active calculation.

Choosing between these two methods is a key part of managing your finances while unemployed. A critical part of understanding what is the federal tax rate on unemployment benefits is knowing how to pay it.

Reporting on Your Tax Return: The Final Step

At the end of the tax year, you will need to report your unemployment income on your federal tax return.

Form 1099-G, Certain Government Payments

In January of the year following the year you received benefits, your state unemployment agency will send you Form 1099-G. This form will report the total amount of unemployment compensation you received during the previous year in Box 1. It will also show the amount of any federal income tax you had withheld in Box 4.

You must use the information on this form to report your unemployment income on your tax return. It is crucial that the amount you report matches what is on the Form 1099-G, as the IRS also receives a copy of this form.

Where to Report the Income

You will report the total unemployment compensation you received on Schedule 1 of your Form 1040. The amount you had withheld will be reported along with any other federal tax withholding from other sources (like a W-2 from a job) on your main Form 1040.

The process of reporting the income is the final step in resolving the question of what is the federal tax rate on unemployment benefits for that tax year. It is where all your income and deductions come together to determine your final tax liability. This makes the inquiry of what is the federal tax rate on unemployment benefits an annual concern.

State Taxes: An Important Additional Consideration

While this guide focuses on the federal level, it is crucial to remember that your state may also tax unemployment benefits. The rules vary significantly from state to state.

- Some states, like California and Pennsylvania, do not tax unemployment benefits at all.

- Most states do tax unemployment benefits, treating them as taxable income.

- A few states have no state income tax at all, so the issue is moot.

It is essential to check the rules for your specific state to understand your full tax picture. The question of what is the federal tax rate on unemployment benefits is only one part of the equation; state taxes are the other. Many state unemployment agencies also offer the option to have state taxes withheld from your payments. The question what is the federal tax rate on unemployment benefits should always be followed by asking about the state rate.

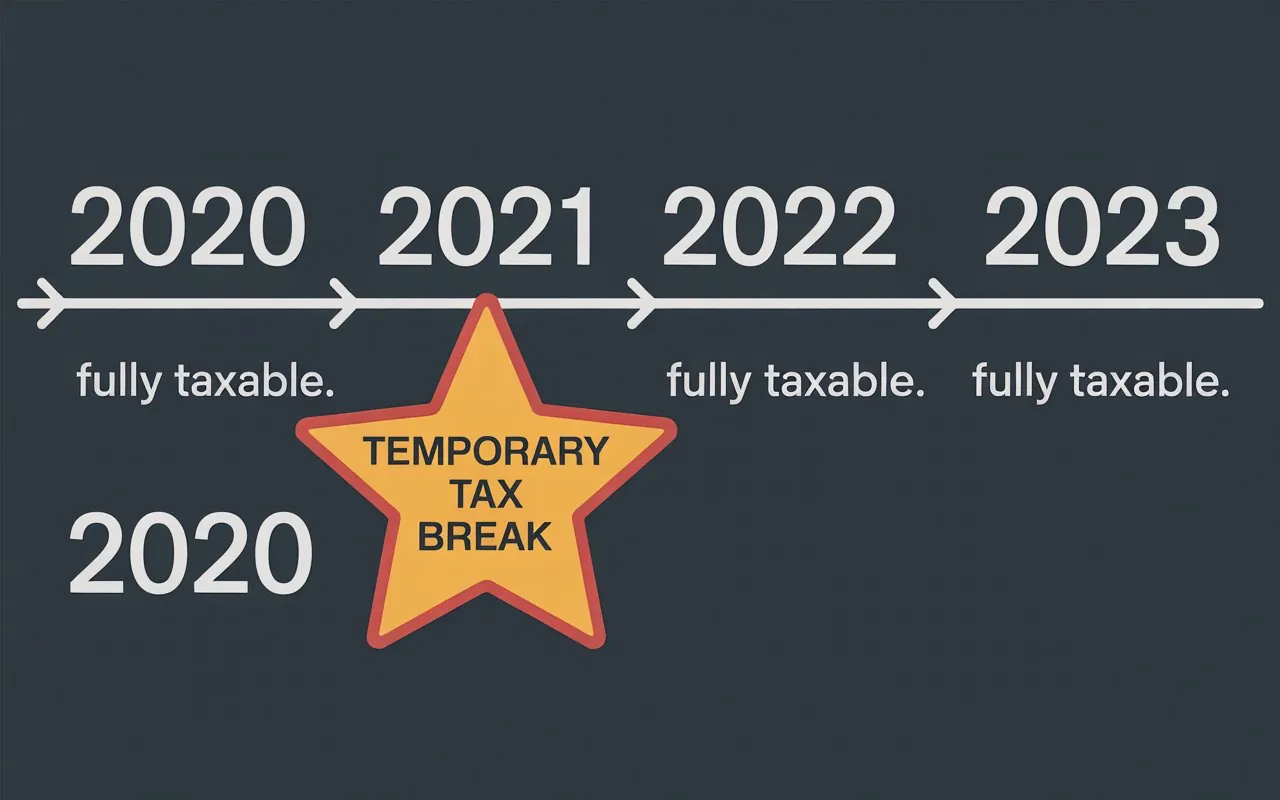

A Special Note on Past Tax Law Changes

It is worth noting that tax laws can and do change. For example, during the COVID-19 pandemic, the American Rescue Plan Act of 2021 made a portion of unemployment benefits received in 2020 non-taxable for certain taxpayers. This was a temporary, one-time exclusion.

This highlights the importance of staying informed about current tax laws. While the default rule is that unemployment benefits are fully taxable, you should always check for any recent legislative changes that might affect your tax return for a given year. These temporary changes can dramatically alter the answer to what is the federal tax rate on unemployment benefits for a specific period. The question of what is the federal tax rate on unemployment benefits is subject to these potential legislative adjustments.

The Final Word: Planning is Key

So, we return to our core question: what is the federal tax rate on unemployment benefits? The definitive answer is that there is no single rate. Your unemployment income is added to your other income, and the total is taxed according to the progressive federal income tax brackets.

The most important takeaway is the need for proactive planning. Understanding that these benefits are taxable is the first step. The second is choosing a strategy to manage that tax liability, whether it’s through voluntary withholding or making quarterly estimated payments. By taking these steps, you can avoid a stressful and potentially costly surprise when you file your taxes.

Navigating a period of unemployment is challenging enough without adding tax problems to the mix. By understanding the answer to what is the federal tax rate on unemployment benefits and taking control of your tax situation, you can better manage your finances and focus on what matters most: your journey back to employment. The question of what is the federal tax rate on unemployment benefits is one that every recipient should ask and answer early in the process. Your future self will thank you for it. The query what is the federal tax rate on unemployment benefits is a sign of a financially responsible individual.