Embarking on the journey of entrepreneurship is one of the most exciting and challenging endeavors a person can undertake. It’s a path defined by innovation, passion, and the pursuit of a unique vision. Beyond the satisfaction of building something from the ground up, there is a significant financial upside that many aspiring business owners are curious about. This leads to one of the most important and practical questions in the world of business: what are the tax benefits of owning your own business? The answer to this question reveals a world of strategic advantages that can significantly impact your bottom line and fuel your company’s growth.

This guide is designed to be your definitive resource, demystifying the complex world of business taxes and illuminating the powerful deductions available to you. We will explore the fundamental principles of business expenses, dive into specific categories of deductions, and provide actionable advice to help you maximize your savings. Understanding what are the tax benefits of owning your own business is not about finding loopholes; it’s about learning the established rules of the system to operate your business in the most financially intelligent way possible. Let’s explore how you can leverage these advantages to build a more profitable and sustainable enterprise.

The Core Principle: Understanding Legitimate Business Deductions

At the heart of the answer to the question, what are the tax benefits of owning your own business, lies a single, powerful concept: the business deduction. As an employee receiving a standard paycheck, you are taxed on your gross income with very limited opportunities to deduct expenses. As a business owner, the paradigm shifts dramatically. You are taxed on your net profit, not your total revenue.

Net Profit = Total Revenue – Ordinary and Necessary Business Expenses

This simple formula is the foundation of all business taxation. An “ordinary and necessary” expense is any cost that is common and accepted in your particular trade or business and is helpful and appropriate for that business. This opens the door to a wide array of deductions that are simply not available to traditional employees. Every legitimate expense you incur to run and grow your business reduces your taxable income, which in turn reduces your tax bill.

This is the fundamental answer to what are the tax benefits of owning your own business. It’s the ability to subtract the cost of doing business from your revenue before the taxman takes his share. This single principle is what makes entrepreneurship so appealing from a tax perspective. Let’s delve into the specific categories where these benefits come to life. A deep understanding of what are the tax benefits of owning your own business begins here.

Key Deductible Expenses: Where You Find the Real Savings

The true power of business ownership comes from the sheer breadth of expenses you can deduct. Exploring these categories is essential for anyone wanting a detailed answer to what are the tax benefits of owning your own business.

The Home Office Deduction

For the millions of entrepreneurs who run their businesses from home, this is one of the most significant deductions available. If you use a part of your home exclusively and regularly for your business, you can deduct a portion of your household expenses.

There are two methods for calculating this deduction:

- The Simplified Method: This allows you to deduct a standard amount per square foot of your home office space, up to a certain limit. It’s easy to calculate and requires less record-keeping.

- The Regular Method: This method involves calculating the percentage of your home that is used for your business. You can then deduct that percentage of your actual home expenses, including mortgage interest, rent, utilities, insurance, and repairs. This method is more complex but can often result in a larger deduction.

This deduction is a prime example when someone asks what are the tax benefits of owning your own business.

Vehicle and Travel Expenses

If you use your vehicle for business purposes, you can deduct the costs associated with that use.

- Standard Mileage Rate: You can deduct a standard amount for every business mile you drive. This rate is set by the tax authority each year and is designed to cover the costs of gasoline, maintenance, and depreciation.

- Actual Expense Method: Alternatively, you can track and deduct the actual costs of using your vehicle for business, including gas, oil changes, repairs, insurance, and depreciation.

Furthermore, if you travel for business, you can deduct many of the associated costs, including airfare, lodging, and 50% of the cost of meals. This is another powerful answer to the question of what are the tax benefits of owning your own business.

Salaries, Wages, and Contractor Fees

The cost of your labor force is a fully deductible expense. This includes:

- Salaries and wages paid to full-time and part-time employees.

- Payroll taxes you pay as an employer.

- Benefits you provide to your employees, such as health insurance and retirement plan contributions.

- Fees paid to independent contractors and freelancers who provide services to your business.

This deduction is a crucial part of the answer to what are the tax benefits of owning your own business, as it allows you to scale your team without bearing the full, pre-tax cost.

Insurance Premiums

The premiums you pay for various types of business insurance are generally deductible. This includes:

- General liability insurance.

- Professional liability insurance (errors and omissions).

- Property insurance for your business assets.

- Workers’ compensation insurance.

- Health insurance premiums for your employees.

For self-employed individuals, you may also be able to deduct the premiums you pay for your own health, dental, and long-term care insurance. This is a significant advantage and a key point when explaining what are the tax benefits of owning your own business.

Retirement Plan Contributions

This is one of the most powerful long-term tax benefits. As a business owner, you can set up a retirement plan for yourself and your employees and make tax-deductible contributions.

- SEP IRA: A Simplified Employee Pension plan allows you to contribute a significant portion of your compensation, and the contributions are deductible for the business.

- SIMPLE IRA: A Savings Incentive Match Plan for Employees is another option that involves both employee and employer contributions.

- Solo 401(k): For self-employed individuals with no employees (other than a spouse), this plan allows you to contribute as both the “employee” and the “employer,” enabling very large tax-deductible contributions.

These plans allow you to save for your future while simultaneously reducing your current tax bill. This dual advantage is a huge part of what are the tax benefits of owning your own business. Understanding this aspect is critical to fully grasping what are the tax benefits of owning your own business.

Depreciation of Assets

When you purchase a significant business asset that has a useful life of more than one year, such as a computer, machinery, furniture, or a vehicle, you generally cannot deduct the entire cost in the year you buy it. Instead, you deduct a portion of the cost over several years through a process called depreciation.

However, special tax rules often allow you to accelerate this process. For example, Section 179 of the U.S. tax code allows you to deduct the full purchase price of qualifying equipment in the year it is placed in service. This can provide a massive, immediate tax deduction. This is a more complex but very powerful element of what are the tax benefits of owning your own business.

What are the tax benefits of owning your own business in a strategic context?

Understanding the list of deductions is one thing, but seeing how they work together strategically is another. The real power of what are the tax benefits of owning your own business comes from layering these deductions to significantly lower your taxable income.

Imagine a freelance graphic designer who earns $80,000 in revenue.

- As an employee, they would be taxed on almost the full $80,000.

- As a business owner, they can start subtracting expenses:

- Home office deduction: Let’s say $3,000.

- New computer (depreciation): $2,000.

- Software subscriptions: $1,000.

- Internet and phone (business use portion): $600.

- Advertising costs: $1,500.

- Health insurance premiums: $5,000.

- SEP IRA contribution: $15,000.

Their taxable income is no longer $80,000. It’s $80,000 minus $28,100, which equals $51,900. They are only taxed on the profit. This practical example is the clearest way to explain what are the tax benefits of owning your own business. This strategic reduction of taxable income is the essence of what are the tax benefits of owning your own business. Every entrepreneur should understand what are the tax benefits of owning your own business in this way.

The Importance of Meticulous Record-Keeping

Claiming these powerful benefits comes with a crucial responsibility: meticulous record-keeping. To claim a deduction, you must be able to prove that the expense was incurred and that it was for a legitimate business purpose.

- Keep All Receipts: Whether digital or paper, you must keep receipts for all business expenses.

- Use Separate Bank Accounts: Never mix your business and personal finances. Open a dedicated business checking account and use it for all business income and expenses. This makes tracking your finances infinitely easier.

- Use Accounting Software: Modern accounting software can help you categorize your expenses, track your mileage, and generate financial reports, making tax time much less stressful.

- Maintain a Mileage Log: For vehicle expenses, you must keep a contemporaneous log of your business mileage, including the date, destination, purpose, and miles driven for each trip.

Good records are your best defense in the event of a tax audit. Without them, your deductions can be disallowed. This diligence is a non-negotiable part of enjoying the answer to what are the tax benefits of owning your own business. The conversation about what are the tax benefits of owning your own business is incomplete without stressing this point.

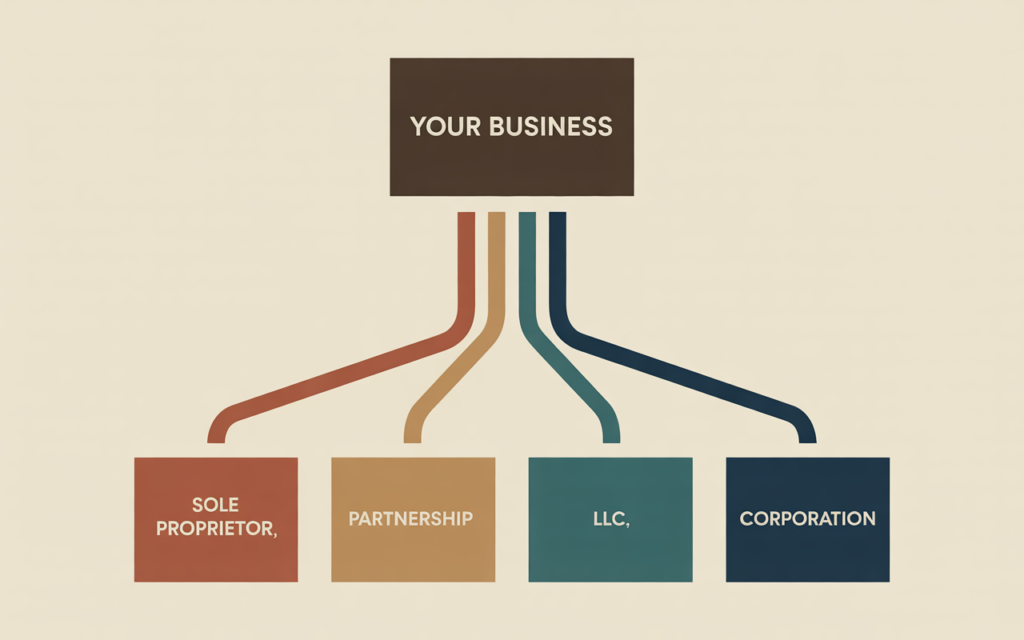

How Your Business Structure Affects the Tax Benefits

The legal structure you choose for your business can also impact your taxes.

- Sole Proprietorship: This is the simplest structure. You and your business are considered a single entity for tax purposes. You report all business income and expenses on your personal tax return (Schedule C).

- Partnership: Similar to a sole proprietorship, but with two or more owners. The profits and losses are “passed through” to the partners to report on their personal tax returns.

- LLC (Limited Liability Company): An LLC provides liability protection. By default, it is taxed like a sole proprietorship (if one owner) or a partnership (if multiple owners), but it can elect to be taxed as a corporation.

- Corporation (S-Corp or C-Corp): Corporations are separate legal and tax entities. An S-Corp allows profits to be passed through to the owners’ personal returns, which can help avoid the “double taxation” found with C-Corps. C-Corps are taxed at the corporate level, and then dividends distributed to shareholders are taxed again at the personal level.

Choosing the right structure can have significant tax implications, especially concerning self-employment taxes. This is a more advanced topic within the broader question of what are the tax benefits of owning your own business, and it is often wise to consult with a legal or tax professional to make this decision. Your choice of entity is a key part of the strategy for what are the tax benefits of owning your own business.

The Final Word: A Powerful Tool for Growth

In conclusion, the answer to the critical question, what are the tax benefits of owning your own business, is that you have the powerful ability to lower your taxable income by deducting all the ordinary and necessary expenses incurred in running your company.

From the home office you work in, to the vehicle you drive for meetings, to the contributions you make to your own retirement, the tax code provides numerous opportunities for entrepreneurs to reinvest in their business and their future. This is not about evading taxes; it’s about understanding the system and using it as it was intended—to encourage and support the small businesses that are the backbone of the economy.

The key to unlocking these benefits lies in knowledge and diligence. By understanding what you can deduct and keeping meticulous records, you can transform your tax obligations from a burden into a strategic tool for growth. The journey of entrepreneurship is challenging, but the financial advantages are real and substantial. Fully understanding what are the tax benefits of owning your own business is one of the most important steps you can take on your path to success. The savvy entrepreneur always asks what are the tax benefits of owning your own business and uses the answer to their advantage. This is the final word on what are the tax benefits of owning your own business.