In today’s unpredictable world, protecting your home and everything inside it is more important than ever. Whether you’re a proud homeowner, a renter furnishing your first apartment, or someone living with valuable sentimental and high-ticket items, having the best insurance home and contents policy is your strongest line of defense against unexpected loss.

Imagine returning home to find your space damaged by floodwaters or discovering a burglary that has left your belongings gone. These situations are devastating, but with a solid insurance policy in place, you can recover without the stress of covering the full financial burden alone. Insurance isn’t just about compliance or mortgage requirements—it’s about security, peace of mind, and the ability to rebuild quickly after disaster strikes.

This guide was specially written for anyone seeking clarity in a confusing market. The rising cost of repairs, increasing burglary rates in urban neighborhoods, and unpredictable weather events mean that insurance isn’t just for the cautious—it’s for the informed. Yet, many policyholders don’t fully understand what’s covered under their current plan—or worse, they’re underinsured or paying too much for too little coverage.

That’s where we come in.

In this comprehensive article, we’ll break down everything you need to know to choose the best insurance home and contents policy that suits your lifestyle, location, budget, and personal needs. We’ll explore different insurance types, explain what is and isn’t covered, introduce you to top providers, and share practical, actionable advice to make your insurance work harder for you.

Whether you’re in Nigeria facing seasonal floods, living abroad with strict insurance policy terms, or simply shopping around for better rates—this guide is packed with valuable insights to help you make the smartest insurance choice possible.

Let’s dive into the world of home and contents insurance—because your home isn’t just your roof and walls. It’s your life.

What Is Home and Contents Insurance?

In simple terms, home and contents insurance is a financial safety net. It protects you against any unforeseen damage to your house and its contents caused by events like fire, flooding, natural disasters, or theft. It generally includes:

- Building (or Home) Insurance: Covers the physical structure — your roof, walls, windows, ceiling, flooring, pipes, and permanent fixtures.

- Contents Insurance: Covers all personal belongings inside the house — furniture, clothes, electronics, appliances, jewelry, and valuables.

Together, these policies ensure you can repair, rebuild, and replace your property and possessions in the event of loss or destruction.

Example:

Imagine a fire breaks out in your kitchen (due to a faulty gas cylinder). The flames damage the structure, appliances, and dinnerware. With the right home and contents insurance, your kitchen will be rebuilt and your lost items replaced — with little or no cost to you.

Why You Need the Best Insurance Home and Contents Policy

Many people think, “It won’t happen to me.” Until it does.

Key Reasons to Get Covered:

- Disaster Recovery: Insurance cushions homeowners and renters against massive financial setbacks after a disaster.

- Peace of Mind: You never have to wonder, “How will I pay for repairs or replacements?”

- Legal or Contractual Requirements: If you’re buying a home with a mortgage, lenders often require you to have home/building insurance.

- Rising Risks: Climate change, electricity surges, and increased burglary make insurance more critical than ever, especially in areas like Lagos, Abuja, or Port Harcourt.

Difference Between Building and Contents Insurance

| Insurance Type | What It Covers | Who Needs It |

|---|---|---|

| Buildings Insurance | The structure of the home, permanent fixtures, garage, roof | Homeowners and Landlords |

| Contents Insurance | Moveable possessions like electronics, clothes, furniture | Renters and Homeowners |

| Combined | Both structure and possessions | Homeowners (especially with loans) |

🛑 Tip: Don’t assume that your landlord’s insurance covers your personal belongings. It doesn’t.

What Should the Best Home and Contents Insurance Cover?

An ideal policy should cover you for the following situations:

💡 Building Insurance Should Include:

- Fire, explosion, lightning, and storm damage

- Damage from flooding or water leakage

- Burglary or vandalism

- Malicious or accidental damage

- Alternative accommodation costs

- Falling trees or damage from vehicles

- Legal liability for injuries on your property

🛋 Contents Insurance Should Include:

- Theft or attempted burglary

- Fire or smoke damage

- Flooding or water damage

- Accidental breakage or spills

- Items taken temporarily outside (phones, jewelry)

- Visitors’ or guests’ belongings (if damaged or lost)

Real-Life Context (Nigeria):

- Lagos residents often face flooding during rainy seasons — you need flood protection.

- In Abuja, power surges can damage electronics — surge protection coverage is helpful.

- Rural areas face events like bushfires — natural disaster coverage matters.

What’s Usually Not Covered? (Common Exclusions)

No insurance policy is perfect — be fully aware of what’s excluded:

- Wear and tear or gradual deterioration

- Mold or pest infestation (e.g., termites or rats)

- Faulty appliances or poor construction

- Damage to unoccupied homes (usually after 30–60 days)

- Lack of maintenance

👉 Always read the PDS (Product Disclosure Statement) to understand the full terms.

Types of Policies: Which One Suits You?

Every household is different. Here’s how to determine what type of cover makes sense for you:

| Situation | Best Policy Type |

|---|---|

| You own a house and live in it | Combined Building and Contents |

| You rent a fully-furnished apartment | Contents insurance (your own items only) |

| You’re a landlord | Buildings insurance with rental income protection |

| You run a business from home | Home + Business Equipment Add-On |

| You own expensive jewelry/art | Contents with Specified Valuables Add-On |

Top Insurance Companies Offering Home and Contents Cover

Here are trusted names in the home and contents insurance space for Nigerian and global audiences:

| Provider | Key Features | Region Served |

|---|---|---|

| AXA Mansard | Budget-friendly plans, digital claims, offer home office cover | Nigeria |

| Leadway Assurance | Customizable premiums, wildfire/kitchen fire protection | Nigeria |

| AIICO Insurance | Comprehensive damage protection, excellent customer support | Nigeria |

| Liberty Mutual | Excellent accidental damage protection, responsive claims | Global (US/UK) |

| NRMA/QBE Australia | Ideal for flood-prone regions, powerful add-ons for climate events | Australia |

| Aviva UK | Strong reputation, discounted bundles for combined cover | UK |

Optional Add-Ons/Riders (Supercharge Your Cover)

| Add-On | What It Covers | Best For |

|---|---|---|

| Accidental Damage | Spills, drops, breakage of furniture or electronics | Families with kids/pets |

| Specified Items | High-value jewelry/art over regular item limits | Owners of unique or precious items |

| Out-of-Home/Portable Cover | Items lost/stolen away from the home | Professionals, Travelers |

| Flood or Storm Extension | Natural disasters and weather-related damage | Riverine or exposed neighborhoods |

| Cyber/Identity Theft | Protection from fraud, cyberattacks, identity misuse | Remote workers or online consumers |

| Home Office Equipment | Laptops, monitors, printers used for business | Freelancers and Small Business Owners |

😎 Pro Tip: Don’t underestimate the value of add-ons—they can make or break a successful claim in critical situations.

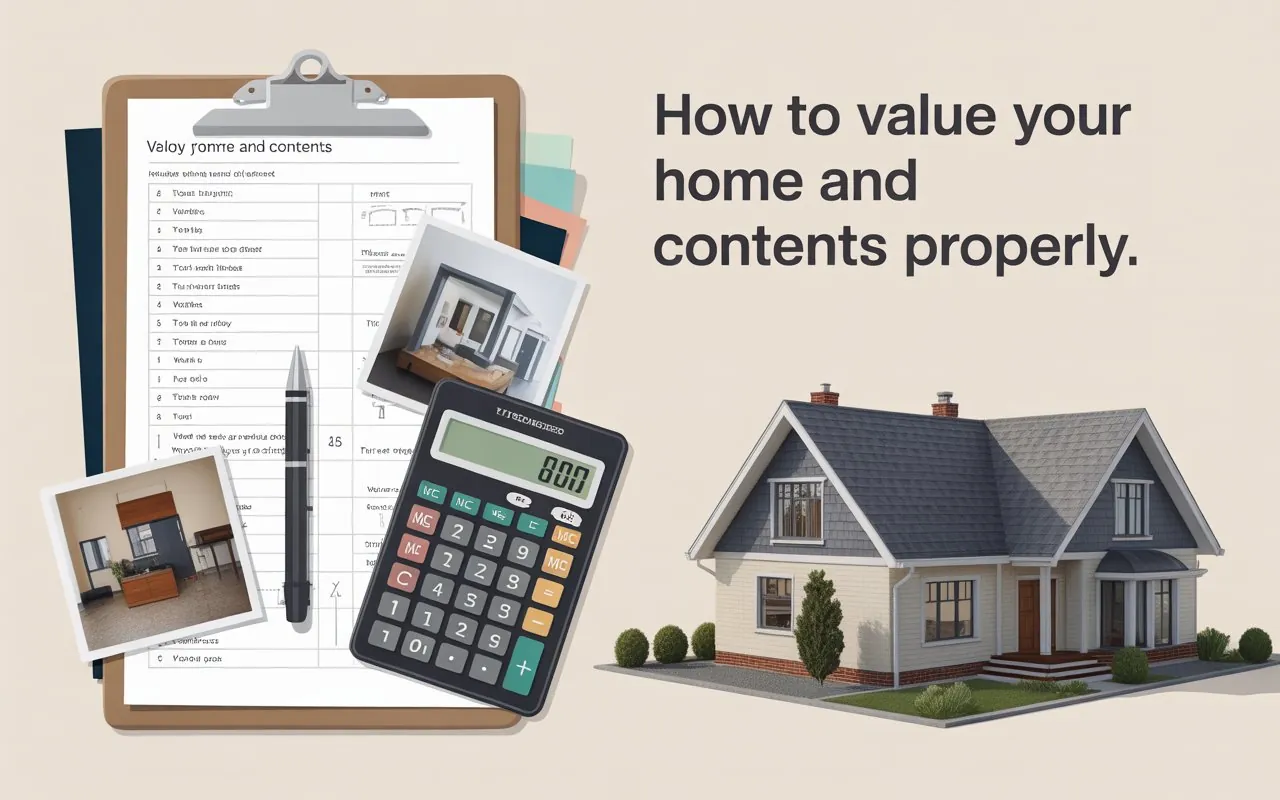

How to Value Your Home and Contents Properly

Many face claims being reduced or denied due to “underinsurance”. To avoid that:

🏡 Assess Your Home:

- Use an online property rebuild calculator

- Consult builders for quotes

- Include fencing, garage, pools, and outdoor kitchens

📦 Assess Your Contents:

- Take an inventory: move room to room

- Capture photos

- Keep receipts and make backups (cloud storage)

Sample Inventory Table:

| Item Type | Quantity | Approx. Value (₦) | Covered? (Yes/No) |

|---|---|---|---|

| Smart TV 55″ | 1 | ₦450,000 | Yes |

| Laptop (MacBook) | 1 | ₦820,000 | Yes (Specified) |

| Jewelry (Gold Set) | 1 | ₦1,500,000 | Yes (Add-On) |

| Washing Machine | 1 | ₦350,000 | Yes |

What to Look for in the Best Insurance Home and Contents Policy

Choosing a policy is a big deal. Here are 10 essential features to check before you buy:

- Clear Definition of Covered Perils: Is everything you need (fire, theft, climate events) listed?

- Flexible Premiums and Excess: Adjustable based on your risk appetite.

- Add-On Customizations: Accidental & portable cover add-ons.

- Worldwide Protection: For portable valuables.

- Home Office Inclusions: Especially helpful post-COVID.

- In-Depth Product Disclosure Statement: Transparency is king.

- Reputation for Claims Handling: Read customer reviews.

- Simple Claims Lodging: Mobile app, email, or phone submission.

- Inclusive for Shared Living: Especially for renters or roommates.

- Reward for No Claim Bonus: Discount over time.

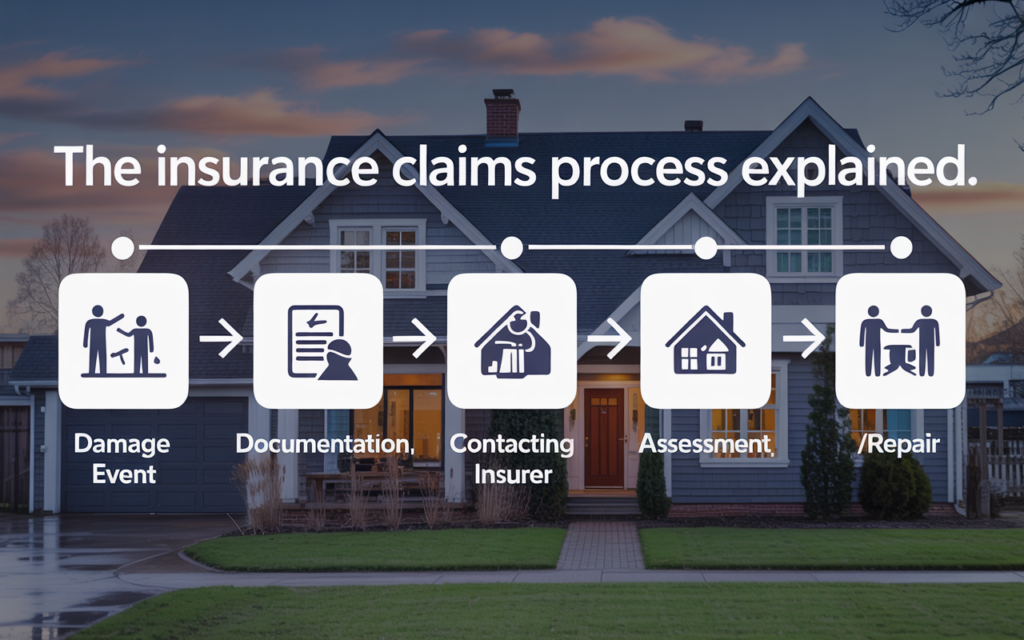

How the Insurance Claims Process Works

Ever worried about submitting a claim? Here’s how it works, step-by-step:

Step-by-Step Claims Journey:

- Emergency Steps: Secure your property (board up windows, stop leaks, etc.)

- Document Everything: Take videos/pictures and save receipts.

- Lodge Claim Promptly: Call hotline or visit online claim portal.

- Supply Proof: Provide inventory, receipts, and police reports.

- Adjuster Visits (If Needed): Inspection and estimate of repair/replacement.

- Await Decision: Typically 1-2 weeks unless issues arise.

- Receive Payout or Replacement: Funds, repairs, or replaced items.

Money-Saving Tips + Common Mistakes to Avoid

💸 Ways to Save:

- Pay annually instead of monthly (save up to 10%)

- Increase your excess for a lower premium

- Install burglar alarms or cameras

- Bundle other policies (car, health)

- Apply for online-exclusive promotions

❌ Mistakes to Avoid

- Assuming landlord’s insurance covers you

- Undervaluing your possessions

- Failing to read the fine print

- Delaying claims – time limits apply

- Not updating your policy after renovations/new purchases

Real-Life Scenarios for Nigerian Residents

✅ Real Story: Water Damage in Lekki

After heavy rains, floods entered Uche’s living room. Thankfully, his building and contents insurance covered furniture and provided a month-long stay at a hotel. Total payout: ₦2.1 million.

❌ Cautionary Tale: Power Surge in Abuja

Olufunmi’s expensive OLED TV was destroyed during a NEPA surge. Unfortunately, his policy excluded “electrical surges.” Lesson: check the policy wording in detail.

✅ Business Owner in Port Harcourt

Chika, who operates a bakery from her home kitchen, added business equipment coverage. When a fire damaged part of her workspace, her policy replaced commercial mixers and stainless-steel worktops.

FAQs About the Best Insurance Home and Contents

Q: Can I cover items in my car parked at home?

A: Usually not unless you add them under portable items or have motor policy overlaps.

Q: Will my work laptop be covered?

A: Only if it’s declared under business or portable cover. Corporate-owned devices may need third-party policies.

Q: Is flooding automatically included?

A: In many Nigerian policies, flooding is an optional rider. Always check.

Q: Can I get cover for solar panels or inverters?

A: Yes, through building extension or “green additions” under some providers.

Q: Are family heirlooms covered?

A: Only if specified and professionally valued.

Conclusion

Your home is your sanctuary, and your possessions help create the lifestyle you’ve worked hard for. Protecting them with the best insurance home and contents policy isn’t just smart—it’s vital. Whether it’s replacing items after a robbery or rebuilding after a fire, insurance ensures that what’s damaged can be repaired, what’s lost can be recovered, and your future remains secure. 👉 Action Step: Begin by listing everything in your home. Then get quotes from at least 3 insurers, compare coverage thoroughly, and opt for a policy that matches your location, lifestyle, and risk exposure. Review annually, and don’t forget those valuable add-ons.