The journey to higher education is filled with excitement, anticipation, and a fair share of administrative hurdles. Among the most pressing concerns for students and their families is securing the necessary funding to make their academic dreams a reality. This leads to a critical, time-sensitive question that can impact everything from registration to housing: how long does a student loan application take to process? The answer is not always straightforward, and the waiting period can be a significant source of stress.

This comprehensive guide is designed to demystify the entire process, providing you with a clear and detailed roadmap of what to expect. We will explore the typical timelines for different types of loans, delve into the various factors that can speed up or slow down your approval, and offer practical, actionable advice to help you navigate the system with confidence. Understanding how long does a student loan application take to process is about more than just managing your patience; it’s about empowering yourself with the knowledge to plan effectively, avoid common pitfalls, and ensure your funding is ready when you need it most.

The Anatomy of a Student Loan Application: Understanding the Stages

Before we can accurately estimate the timeline, it’s crucial to understand the lifecycle of a student loan application. From the moment you hit “submit” to the day the funds are disbursed, your application moves through several distinct stages. Knowing these steps provides context for why the answer to how long does a student loan application take to process can vary so much. Each of these stages contributes to the overall answer of how long does a student loan application take to process.

- Application Submission: This is the initial step where you, the applicant, fill out all the necessary forms. For federal loans in the U.S., this means completing the Free Application for Federal Student Aid (FAFSA). For private loans, it involves completing the specific lender’s application. This stage can take anywhere from 15 minutes to a few hours, depending on how prepared you are with your personal and financial information.

- Document Verification: Once submitted, the lender begins the verification process. They will review all the information and documents you provided to ensure accuracy and completeness. This can include confirming your identity, your admission to an educational institution, and the financial information of you and your co-signer, if applicable. Any missing or inconsistent information at this stage is a primary cause of delays in determining how long does a student loan application take to process.

- Credit Check and Underwriting (Primarily for Private Loans): For private student loans, this is a critical stage. The lender will perform a credit check on you and your co-signer to assess creditworthiness and determine your eligibility and interest rate. The underwriting team evaluates the overall risk of the loan.

- School Certification: For both federal and many private loans, your school’s financial aid office must get involved. They need to certify your enrollment status, your cost of attendance, and confirm that the loan amount you are requesting does not exceed your financial need. The efficiency of your school’s financial aid office can significantly impact how long does a student loan application take to process.

- Loan Approval and Offer: After all checks are complete, the lender will make a final decision. If approved, you will receive a loan offer detailing the amount, interest rate, fees, and repayment terms.

- Acceptance and Signing: You must formally accept the loan offer and sign the loan agreement or Master Promissory Note.

- Disbursement: This is the final step where the lender sends the funds. In most cases, the money is sent directly to your school, which applies it to your tuition and fees. Any remaining balance is then refunded to you.

How Long Does a Student Loan Application Take to Process: The Timelines

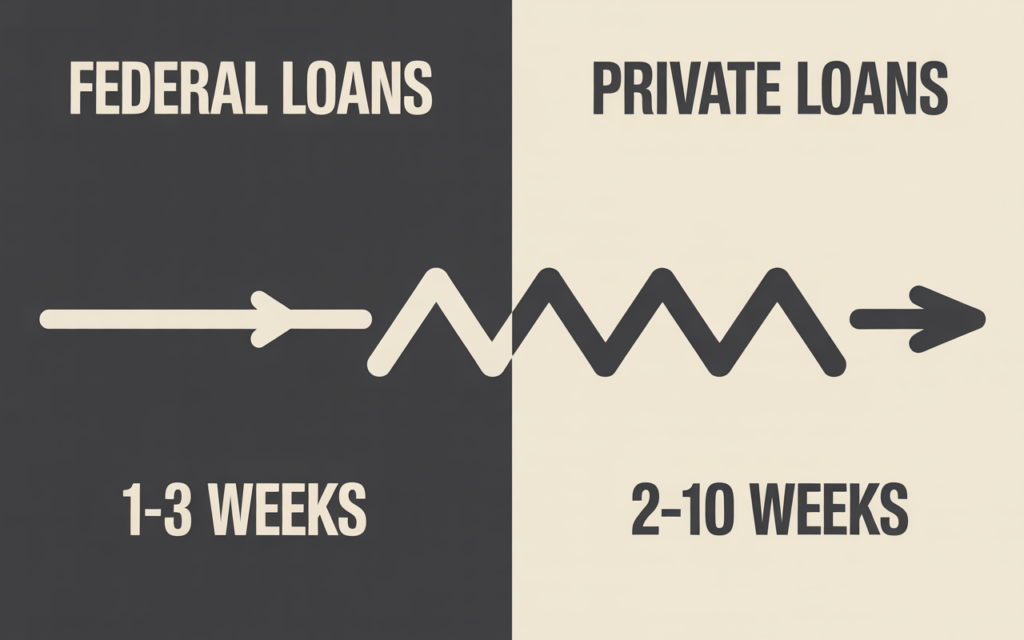

Now, let’s address the core question directly. The answer to how long does a student loan application take to process depends heavily on whether you are applying for a federal or private loan.

Federal Student Loan Timeline (e.g., U.S. FAFSA)

Federal loans generally have a more predictable, albeit multi-step, timeline. For federal loans, how long does a student loan application take to process from FAFSA submission to disbursement can take anywhere from one to three weeks, but it can sometimes extend longer, especially if there are complications.

- FAFSA Processing: After you submit the FAFSA online, it typically takes the U.S. Department of Education 1 to 3 business days to process it. Paper applications can take 7 to 10 days.

- School Review and Awarding: Once your school receives your FAFSA information, their financial aid office will review it and put together a financial aid package for you. This can take several weeks, especially during peak season.

- Disbursement: Federal law dictates that schools cannot disburse federal student aid funds earlier than 10 days before the first day of classes.

So, while the initial application processing is fast, the entire journey to getting the money can take over a month. Therefore, the practical answer to how long does a student loan application take to process for federal aid involves accounting for your school’s timeline as well.

Private Student Loan Timeline

The timeline for private student loans varies much more widely between lenders. Generally, you can expect the process to take anywhere from two to ten weeks. The answer to how long does a student loan application take to process for private loans is less clear-cut.

Some modern online lenders can provide an instant credit decision within minutes of you submitting your application. However, the subsequent steps of verification, school certification, and final disbursement still take time. Other traditional banks or credit unions may have a more lengthy manual review process. The significant range in this timeline is a key aspect of understanding how long does a student loan application take to process in the private market. Knowing that this can take over two months is critical for students who ask how long does a student loan application take to process.

Factors Influencing How Long a Student Loan Application Takes to Process

Several key variables can impact the speed of your application. Being aware of these can help you manage your expectations and avoid unnecessary delays. If you’re wondering why your application is taking longer than expected, the answer to how long does a student loan application take to process for you likely involves one of these factors.

Completeness and Accuracy of Your Application

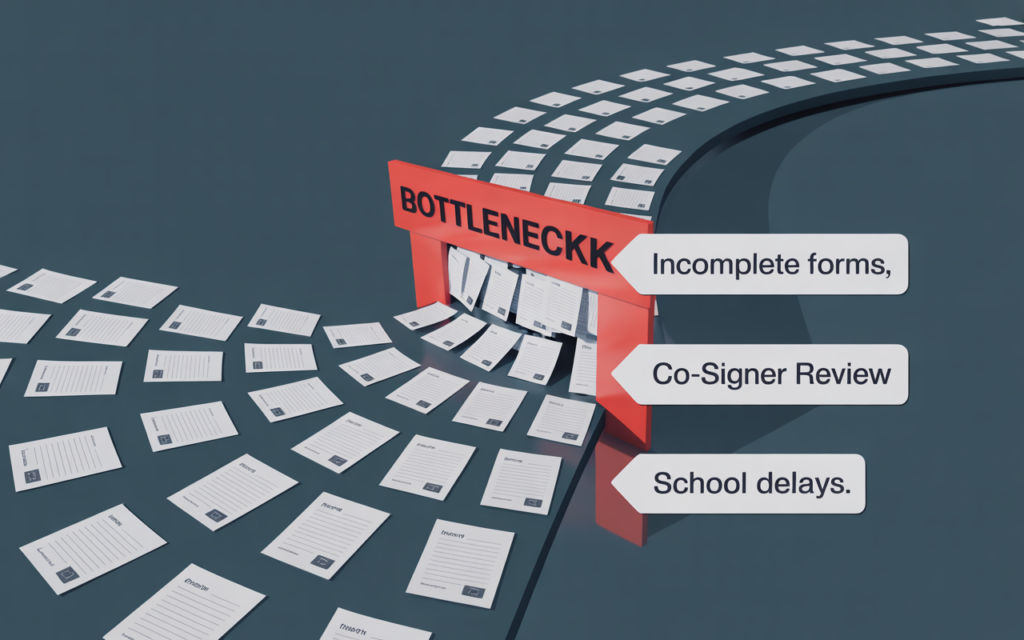

This is the most common cause of delays. A simple mistake, a missing signature, or an incomplete form can send your application to the back of the queue. Lenders cannot proceed until they have all the required information in the correct format. The completeness of your forms is the #1 factor in determining how long does a student loan application take to process.

The Need for a Co-signer

For private loans, if you have a limited credit history, you will likely need a co-signer. The process of finding a willing and qualified co-signer, having them submit their financial information, and undergoing a credit check can add significant time to the process. Adding a co-signer adds steps, which naturally affects how long does a student loan application take to process.

The Verification Process

A certain percentage of federal aid applications are selected for a process called “verification,” where the school’s financial aid office must confirm the accuracy of the information you provided. This requires you to submit extra documentation, like tax returns or proof of income, and can add several weeks to your timeline. Being selected for verification will greatly extend how long does a student loan application take to process.

Your School’s Financial Aid Office

As mentioned, your school plays a critical role. The speed at which they can certify your loan is a major factor. During peak times, like the weeks leading up to the fall semester, financial aid offices are inundated with requests, which can create a bottleneck. The efficiency of your school’s financial aid office dramatically impacts how long does a student loan application take to process.

The Lender’s Internal Processes

Every lender has its own internal workflow and staffing levels. Some are simply more efficient than others. A small credit union might have a more personal but slower process, while a large online lender might have a highly automated but less flexible system. This is an unavoidable part of how long does a student loan application take to process.

Tips to Shorten How Long a Student Loan Application Takes to Process

While some parts of the timeline are out of your control, there are several proactive steps you can take to make the process as fast as possible. If you want a shorter answer to how long does a student loan application take to process, follow this advice.

- Apply Early: This is the single most important tip. The student loan process is not something to be left until the last minute. Start the application process several months before your tuition deadline. For federal loans, fill out the FAFSA as soon as it becomes available. Applying early is the best way to ensure how long does a student loan application take to process is as short as possible.

- Gather Your Documents in Advance: Before you even start the application, gather all the necessary documents. This may include your Social Security number, tax returns, bank statements, and proof of admission. If you need a co-signer, have them gather their information as well. Being prepared directly shortens how long does a student loan application take to process.

- Double-Check Everything: Before you hit submit, review your entire application for accuracy. Check for typos, ensure all fields are filled, and make sure you have signed in all the required places. Accuracy is essential to controlling how long does a student loan application take to process.

- Be Responsive: Keep a close eye on your email and mail. If the lender or your school requests additional information, respond as quickly and completely as possible. The clock is often paused while they wait for you. Your responsiveness is key to influencing how long does a student loan application take to process.

- Follow Up: Don’t be afraid to politely follow up with the lender and your school’s financial aid office. A courteous phone call or email can sometimes help move your application along or identify a problem you weren’t aware of. Active follow-up can make a difference in how long does a student loan application take to process.

Common Mistakes to Avoid

Avoiding these common pitfalls can prevent major delays and give you a more predictable answer to how long does a student loan application take to process.

- Missing Deadlines: Both federal aid and some schools have specific deadlines for applications. Missing these can jeopardize your ability to get funding for that term.

- Using Incorrect Information: Using a nickname instead of your legal name or mistyping your Social Security number can cause your application to be rejected or flagged for verification. This mistake can greatly extend how long does a student loan application take to process.

- Assuming an Instant Approval is Final: Some private lenders offer “instant pre-approval,” but this is not the same as a final, disbursed loan. The subsequent steps of verification and certification still need to be completed.

- Not Reading the Fine Print: Before you sign any loan agreement, read it carefully. Understand the interest rate, fees, and repayment terms. Rushing this step can lead to costly surprises down the road.

Final Thoughts: Planning for a Smooth Process

We return to our central question: how long does a student loan application take to process? As we’ve explored, the answer is a range, not a single number. For federal loans, a safe estimate is to plan for at least a month from FAFSA submission to disbursement. For private loans, planning for a one-to-two-month window is a prudent approach.

The key to a stress-free experience lies in preparation, diligence, and starting early. By understanding the stages of the application, being aware of the factors that can cause delays, and taking proactive steps to ensure your application is complete and accurate, you can take control of the process. So, in conclusion, how long does a student loan application take to process? The answer depends heavily on your planning.

The journey to funding your education is a marathon, not a sprint. Knowing how long does a student loan application take to process allows you to set a realistic pace, ensuring you cross the financial finish line well before your classes begin. This knowledge is your first and most powerful tool in building a solid financial foundation for your academic career. This knowledge is your most powerful tool in navigating how long does a student loan application take to process.