Are you wondering how to apply for PNC credit card and want a clear, straightforward guide that helps you every step of the way? Whether you’re just starting your credit journey, looking to consolidate debt, or aiming to maximize your rewards potential, understanding this process is crucial for success. PNC Bank offers a variety of credit cards tailored to different financial goals, which makes choosing the right one an important decision. This article will walk you through exactly what you need to know—from evaluating card options and eligibility requirements to submitting an effective application and managing your card after approval.

Applying for a credit card might feel intimidating, especially with so many choices and terms to consider. But with precise guidance, practical examples, and insider tips, you’ll gain confidence and clarity on how to approach the application process. Beyond just the steps, we’ll cover helpful strategies for improving approval chances and using your card wisely for long-term financial benefits. Plus, no matter where you are in the world—including international contexts like Nigeria—this guide offers actionable insights relevant to your situation.

By the end of this article, you’ll not only know how to apply for a PNC credit card but also how to pick the best card for your unique lifestyle, income, and spending habits. You’ll learn how to prepare your documentation, avoid common pitfalls, and make informed decisions that help build your creditworthiness and unlock meaningful rewards. Let’s get started on your path to smarter, more beneficial credit card use with PNC.

Why Choose a PNC Credit Card? Advantages to Consider

Before diving into how to apply for PNC credit card, it’s important to consider why people worldwide choose PNC Bank credit cards over the competition. PNC is among the largest and most reputable banks in the United States, offering a wide range of personal finance solutions. Here’s why their credit cards might be right for you:

1. Broad Selection of Card Types

Unlike banks that offer just one or two, PNC delivers cards tailored to nearly every need:

- Cash Back Cards: Get monthly savings on essentials like gas, groceries, restaurants, and more.

- Travel and Rewards Cards: Earn points redeemable for flights, hotels, and merchandise, often with travel perks.

- Low Interest/Balance Transfer Cards: Seamlessly move high-interest debt and save on interest payments.

- Business Credit Cards: For entrepreneurs seeking control, tracking, and rewards for company purchases.

2. Digital Tools and Financial Wellness Support

With a strong mobile app, real-time alerts, FICO® Score access, budgeting tools, and 24/7 online banking, PNC makes managing your card and finances intuitive, even for beginners.

3. Global Acceptance and Security

All PNC credit cards are issued on the Visa® network—ensuring broad acceptance, layered fraud protection, zero liability for unauthorized purchases, and robust customer service worldwide.

4. Bespoke Extras and Perks

Depending on the card, you may get:

- Introductory 0% APR: Pay no interest on purchases or balance transfers for an extended period.

- No Annual Fee Options: Keep costs low.

- Special Offers: Discounted tickets, travel insurance, purchase protection, automatic statement credits, and more.

In-Depth: Exploring the PNC Credit Card Range

To maximize your experience when searching how to apply for PNC credit card, first understand PNC’s current credit products. Let’s unpack each, along with sample use cases:

PNC Cash Rewards® Visa® Credit Card

Main Benefits:

- Up to 4% cash back at gas stations, 3% at restaurants, 2% at grocery stores, and 1% elsewhere.

- $200 sign-up bonus (offer subject to change).

- No annual fee.

Ideal For: People who spend heavily in everyday categories and want to maximize cash rewards.

Example Usage: Commuters or families with regular gasoline, dining out, and grocery shopping expenditures.

PNC Core® Visa® Credit Card

Main Benefits:

- 0% intro APR for purchases and balance transfers for the first 15 billing cycles.

- Among PNC’s lowest ongoing APR options.

- No annual fee.

Ideal For: Those aiming to pay down existing debt or who plan a large purchase and want to avoid interest for over a year.

Example Usage: Transferring a $2,000 balance from a high-interest card; using the savings to pay off principal faster.

PNC Cash Unlimited® Visa® Credit Card

Main Benefits:

- Unlimited 1.5% cash back on all purchases.

- No category restrictions—easy rewards tracking.

- No annual fee; no foreign transaction fees.

Ideal For: Anyone seeking straightforward, flat-rate cash back; frequent travelers who need global acceptance.

Example Usage: Digital nomads, international students, or business travelers.

PNC Points® Visa® Credit Card

Main Benefits:

- Earn points on every purchase, redeemable for travel, merchandise, gift cards, and more.

- Flexible redemption program.

Ideal For: Shoppers who prefer points over cash, and those who enjoy customizing their rewards.

Example Usage: Frequent shoppers and those chasing diverse redemption options.

PNC Business Credit Cards

Includes multiple options for small and midsize companies, with features like expense tracking, employee cards, reward points, and statement credits.

Ideal For: Entrepreneurs, business owners, freelancers managing company expenses through a dedicated line of credit.

Example Usage: Small business paying for supply chain costs, travel, and tech subscriptions, all earning back points or cash.

How to Choose the Right Card?

Ask yourself:

- Where do I spend most? (Gas, groceries, travel, online shopping, etc.)

- Do I plan to carry a balance? (If yes, prioritize low APR.)

- Do I need flexible rewards or simple cash back?

- Am I building credit from scratch—or rebuilding?

By answering these, you’ll pinpoint the right PNC option before proceeding to the application.

Eligibility: What You Need Before You Apply for a PNC Credit Card

Before getting started with how to apply for a PNC credit card, it’s crucial to evaluate whether you meet the basic qualifications.

Essential Eligibility Criteria

1. Age and Legal Status

- Minimum Age: 18 or older (in most regions/states); 21+ if applying for yourself in some international locations.

- Citizenship: Must be a U.S. citizen or permanent resident for most personal cards. Some exceptions for business or student cards may apply.

2. Residence

- U.S. Address: Personal cards require a permanent U.S. address (businesses also need to be U.S.-based).

- International Applicants: If you’re overseas (in countries like Nigeria, India, or the UK), you may only be eligible for select offerings (like business/investment accounts). Confirm with PNC directly.

3. Creditworthiness

- Credit Score: For most PNC cards, a good FICO® score (670+) is recommended; premium or rewards cards often require very good to excellent credit (740+).

- Credit History: Newcomers or students may qualify for entry-level cards with little or no history.

4. Income and Financial Stability

- Proof of Income: You need to demonstrate steady income to assure PNC you can pay back credit borrowed.

- Debt-to-Income Ratio: Lenders consider your current debts (rent, mortgage, loans, etc.) compared to your monthly income.

5. Legal Documents

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) (for personal cards).

- Business tax ID for commercial applications.

What if You Don’t Meet All Requirements?

If your credit is limited, you might:

- Apply for a secured card (if available) to build credit over 6–12 months before targeting higher-tier PNC cards.

- Add a co-signer or authorized user.

- Improve credit score by paying down debts, catching up on bills, and disputing report errors.

Documents and Information Needed When Applying

To streamline the application process, gather the needed info in advance. Here’s what PNC typically requires:

- Personal details: Full legal name, birthdate, citizenship status.

- Contact info: Home address, phone, email.

- ID numbers: SSN/ITIN; for business cards, Employer Identification Number (EIN).

- Financials: Gross monthly/annual income, place of employment, phone, and address.

- Monthly expenses: Rent/mortgage, existing debts.

- Housing status: Own, rent, or other arrangement.

- Optional: Name of co-applicant, if applying jointly or as a business partnership.

Having these at your fingertips ensures a smooth application and minimizes rejection due to incomplete information.

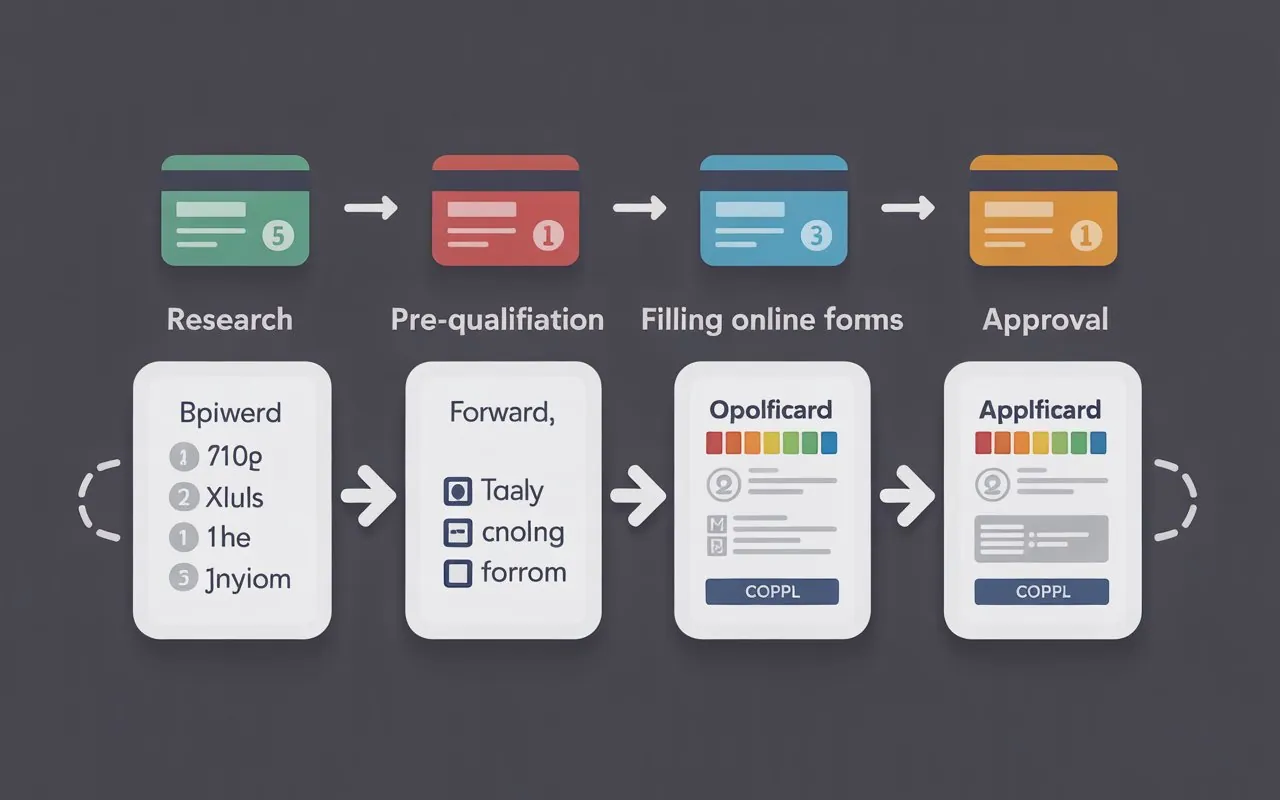

How to Apply for a PNC Credit Card: Step-by-Step Process

Once you’ve prepared, it’s time for action. Whether you’re applying online, via mobile, or in person, this guide details each stage and shares practical tips for worldwide applicants.

1. Research and Select the Best Card

Explore the PNC official credit card comparison tools for up-to-date card features, APRs, rewards, and fee structures. Take time to use calculators or chat with customer care for custom advice.

Real Example:

Maria spends $400/month on groceries and $200 on gas. After calculating, she sees the Cash Rewards® card would earn her $20–$30 more per month vs. flat-rate cards.

2. Check for Pre-Qualification (Pre-Approval Option)

Many applicants hesitate, worried about hurting their credit score. Luckily, PNC allows you to complete a pre-qualification check:

- Enter basic info (name, address, last four digits of SSN).

- Get instant feedback about your odds—without a hard inquiry.

- If you’re pre-qualified, actual approval is very likely if your situation hasn’t changed.

Pro Tip:

If you’re declined for pre-qualification, focus on alternatives or take actions to improve your profile before completing a formal application.

3. Begin the Secure Application

Choose how to apply:

- Online (fastest): Via desktop or mobile from anywhere.

- In Branch: Meet with a banker for guided, in-person help with your application.

- Phone Application: Call the official PNC number for step-by-step phone support.

Online Application Detailed Steps:

- Go to the PNC Bank website or mobile app.

- Click “Apply Now” on your selected card.

- If a PNC customer, log in for auto-filled details; otherwise, continue as guest.

For International Applicants:

If you’re abroad or don’t have a U.S. address, call PNC’s international banking line, or use an American address with documentation if you’re relocating soon.

4. Fill Out the Application Thoroughly

Be ready to provide or confirm:

- Residence and time at current address.

- Total (gross) annual income.

- Employer’s full details, with industry, position, and tenure.

- Housing cost (monthly rent or mortgage payment).

- Optional: secondary income, co-signer, business partner info.

Pro-tip: Triple-check for spelling errors, address mismatches, or missing digits—these are the most common causes of application delay or rejection.

5. Agree to Terms and Submit

You’ll be presented with:

- Disclosure of annual fees (if any), APR, billing cycle rules, late/over-limit fees, rewards program details, privacy policy.

- Required consent to a hard credit check.

- Legal certification of information accuracy.

Read every clause. Misrepresentation can result in automatic denial or future closure.

6. Wait for a Response

- Instant Decision: Often, qualified applicants hear back in minutes.

- Further Review Needed: If info is missing, or extra verification is needed, expect an email or call with further instructions.

- Mail Notification: Others receive their approval or denial via mail, within 7–14 business days.

- Special Cases: Non-U.S. residents, business applicants, or those with new credit may have slightly longer timelines.

How to Track Your Application Status

After submitting, don’t sit in the dark! You can track your PNC credit card application status in several ways:

- Visit PNC’s website and use their application status feature (requires reference number/email confirmation).

- If you applied as a customer, log into your PNC online banking account for updates.

- Contact PNC’s customer care (phone, email, or branch).

- Watch for email or letter updates usually sent within a week.

If you’re not approved: PNC sends an “adverse action notice” including reasons—such as “insufficient income,” “low credit score,” or “recent delinquencies.” Use this feedback to strengthen your next application.

Insider Tips: Maximizing Approval Odds for Your PNC Credit Card

Wondering how to apply for PNC credit card with the best chance of success? Here’s an expanded set of actionable tips:

1. Review Your Credit Reports

Before applying:

- Request free copies from Equifax, Experian, and TransUnion.

- Dispute errors like incorrect late payments or fraudulent accounts.

- Pay off overdue debts—a small change can boost your score quickly.

2. Limit Recent Inquiries

Multiple hard pulls in a short timeframe (applying for several credit products at once) can make you look risky to lenders. Only apply after pre-approval, and wait 3–6 months between applications if you’ve been denied elsewhere.

3. Mind Your Income-to-Debt Ratio

If more than 40% of your monthly income goes to existing debt, pay down loans or cards first, then reapply to PNC.

4. Prepare Explanations for Unique Circumstances

Recently switched jobs or moved? Be able to document these changes. Unusual financial events sometimes cause automated denials but can be overridden by human review with the right evidence.

5. Consider a Secured Entry

If you’re rebuilding credit (score < 600), apply for a secured card (backed by a refundable deposit) offered by PNC or alternatives. Use it responsibly for 6–12 months, then request an upgrade.

6. Use Pre-Qualification Tools

As emphasized earlier, pre-qualification checks let you gauge eligibility without a score impact—a huge asset for cautious applicants.

What to Expect After Approval: Next Steps

So, you’ve figured out how to apply for PNC credit card, submitted your application, and received your approval. What’s next?

1. Receiving Your Card

- Cards arrive in 7–10 business days, via secure mail.

- For urgent needs, ask if expedited shipping or digital card delivery is available.

2. Activate Your Card

Instructions come with your physical card, usually involving:

- Visiting the PNC activation website.

- Calling a toll-free number and following prompts.

- Verifying your identity for security.

3. Set Up Digital Access

- Download the PNC Mobile Banking app (iOS/Android).

- Enroll with your card details, create login credentials.

- Set up transaction alerts, paperless statements, FICO® Score monitoring, and autopay.

4. Use Responsibly

- Make at least the minimum payment every month—but aim to pay in full to avoid interest.

- Track your spending via the app.

- Use card-based budgeting tools and set up custom alerts for large purchases or international transactions.

- Redeem rewards regularly to avoid expiry.

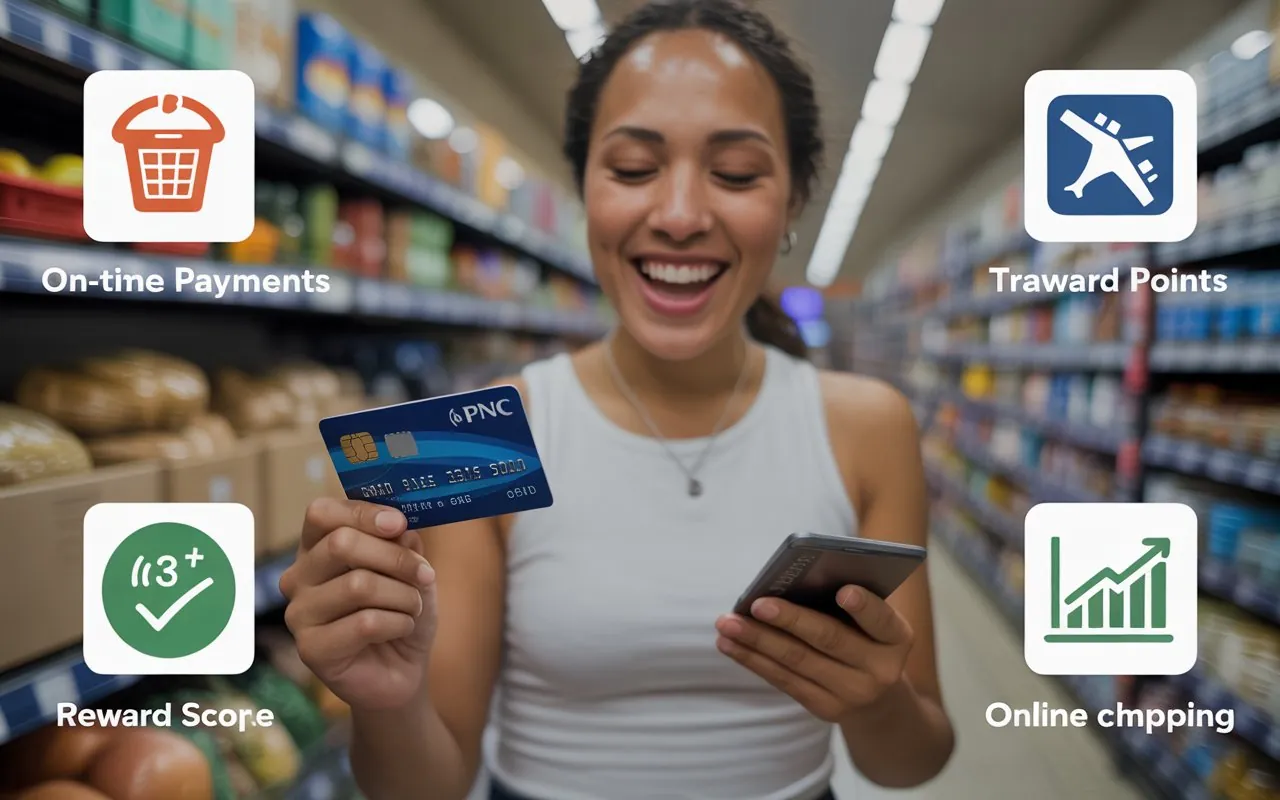

Smart Strategies: Beyond Application to Long-Term Success

Now you know how to apply for PNC credit card, but let’s ensure you’re also positioning yourself for success and leveraging your card to the fullest.

1. Build or Repair Credit

Pay on time—every month. Even a single late payment can drag your score down for years. Set reminders and use autopay whenever possible.

2. Control Utilization

Keep your average monthly balance below 30% of your total credit limit for a positive impact on your credit score. If your limit is $5,000, avoid exceeding $1,500 in charges at any time.

3. Make the Most of Rewards

Apply your points or cash back regularly:

- Set up automatic redemptions to your account or statement.

- Redeem for partner discounts or travel for higher value.

- Monitor for promotions or annual bonuses.

4. Travel and Security Tips

- Notify PNC of foreign travel for seamless card use.

- Use virtual card numbers (if offered) for online shopping.

- Leverage PNC’s zero liability and fraud monitoring features.

5. Review Your Card Annually

Banks regularly update card features. Annually reassess your needs and see if a product change (switching to a different PNC card) could unlock better rewards, lower fees, or other perks.

Common Questions and Expert Answers: Applying for PNC Credit Cards

Can I get a PNC credit card from outside the United States?

Generally, PNC personal credit cards require a U.S. address. However, business and wealth management customers may have other options. Contact PNC’s international banking desk for case-by-case solutions—especially relevant for expats, new arrivals, or U.S. citizens abroad.

Does applying affect my credit score?

A hard pull (upon submission) may lower your score by 3–10 points temporarily. Pre-qualification checks do not impact your score—so always try these first.

Can I apply if I have little or no credit history?

Yes, for certain cards. PNC may issue entry-level products or secured cards to new-to-credit applicants, especially students or recent immigrants with U.S. documentation.

What happens if I’m denied?

You’ll receive a denial letter (or email) with reasons. Common issues include recent missed payments, too much existing debt, insufficient income, or mismatched information. Next steps include improving your profile (pay off debt, update credit files), then reapplying after six months.

Can I have more than one PNC credit card?

Absolutely! As your income or credit needs grow, having multiple cards (e.g., one for personal and another for business) is common. However, don’t open too many at once, as this can affect your credit profile.

conclusion

Deciding how to apply for PNC credit card is only the first step in building a healthier financial life. PNC’s variety of credit cards suit nearly every personal and business need—from maximizing rewards to consolidating debt or traveling smarter. By carefully reviewing your eligibility, gathering your documentation, and using pre-qualification tools, you’ll position yourself for approval and long-term credit success.