Are you a QVC enthusiast looking to elevate your shopping experience, or perhaps a newcomer just discovering the perks of shopping on this popular network? Whatever your situation, knowing exactly how to apply for QVC credit card can open doors to a range of exclusive benefits, from special financing options to member-only discounts and priority customer service. QVC, which stands for Quality Value Convenience, is a globally recognized shopping platform, presenting thousands of products daily on live television, online, and through its mobile app. Yet, many shoppers are unaware that the QVC credit card—also called the QCard—can transform the way you shop, making every purchase more rewarding.

The process of getting the QVC credit card, however, can feel overwhelming for first-time applicants or those unfamiliar with retail-branded credit lines. Maybe you’ve wondered whether you’re eligible, what kind of approval odds you have, or if you really need another card in your wallet. Perhaps you’re from outside the United States and curious if there’s a way to join in the QVC rewards community. In this ultimate guide, we’ll answer every question related to how to apply for QVC credit card, unpack the requirements, and shine a light on the perks that set the QCard apart from traditional cards.

Why should you care? Store credit cards have evolved well beyond simple loyalty cards; they now present powerful financial tools that, when used wisely, deliver substantial savings and added purchasing flexibility. The QVC credit card is no exception: cardholders gain access to QVC’s signature “Easy Pay” installment plans, time-limited 0% APR promotions, bonus coupons, advance invitations to sales events, personalized birthday rewards, and seamless account management through their partnership with Synchrony Bank. For frequent QVC shoppers, or those making occasional big-ticket purchases such as home electronics, jewelry, appliances, or fashion, the advantages can be significant.

In today’s world of rising costs and growing interest in smart budgeting, learning how to apply for QVC credit card gives you more control and flexibility over your purchases. Imagine splitting that must-have kitchen gadget or designer bag into easy monthly payments, enjoying special offers reserved for cardholders, and securing purchases with added fraud protection—all while building your credit history if payments are made responsibly. Even if you live outside the U.S. and can’t access the QCard directly, understanding its features helps you compare options or prepare for future eligibility.

This comprehensive guide is designed for readers worldwide. Whether you’re shopping from the U.S., the U.K., Nigeria, or anywhere else, you’ll find practical, actionable steps for the QCard application process, pro tips to maximize rewards, troubleshooting advice for tricky situations, and guidance on deciding if a store credit card suits your lifestyle. We’ll even highlight inspiring case studies from real shoppers who’ve successfully used their QVC credit card to manage expenses and earn valuable perks.

So, let’s dive in! If you’ve ever typed “how to apply for QVC credit card” into a search engine or wondered what makes the QCard unique, this article promises to give you everything you need to make a smart, confident application—and take full advantage of everything QVC has to offer.

Understanding Store Credit Cards and QVC QCard Basics

What is a Store Credit Card?

Before jumping into steps on how to apply for QVC credit card offers, let’s clarify: What exactly is a store credit card, and how does it differ from a normal credit card?

A store credit card (also called a retail or private-label card) is issued by retailers in partnership with a bank or lender. These cards are typically designed for exclusive use at that particular store (and possibly sister sites/brands). They reward frequent shoppers with perks like:

- Exclusive discounts

- Special financing

- Easier payment plans

- Loyalty bonuses

Key Distinction:

- Store-branded cards (like QVC QCard): Used for purchases at the store or network of related sites only.

- General credit cards (Visa, Mastercard): Accepted almost everywhere; not limited to one retailer.

The QVC Credit Card (QCard) at a Glance

The QVC credit card, formally called the QCard, is issued by Synchrony Bank in partnership with QVC. It’s specifically designed for QVC shopping—but that includes a whole network:

- Qvc.com

- QVC Live TV and app

- Partnered brands: HSN, Zulily (with some cross-usage features)

Key features:

- No annual fee

- Special financing offers (“Easy Pay” and promotional 0% APR)

- Exclusive QVC discounts

- Online management tools

- Fraud protection and secure payment system

If you’re a devoted QVC fan—shopping for electronics, home goods, fashion, or beauty—the QCard can make your experience smoother, more flexible, and more rewarding.

<a id=”section2″></a>

Unpacking the Benefits of QVC Credit Card

Understanding exactly why and how the QVC credit card might enhance your shopping is crucial. Here’s an in-depth look at the benefits you get once you learn how to apply for QVC credit card products successfully:

1. “Easy Pay” Installment Purchases

One of QVC’s trademarks is their Easy Pay option. With QCard:

- Split purchases into affordable, fixed monthly payments.

- No additional fees from QVC when you pay off on schedule.

- Ideal for big-ticket items—TVs, jewelry, kitchen appliances, etc.

2. Special Financing Offers

For select items or order amounts:

- Enjoy promotional 0% APR for 9, 12, or 18 months.

- If balance is paid in full by promotional period end, pay no interest.

- After promo period, standard interest applies retroactively if there’s a balance—so plan accordingly!

3. Member-Exclusive Discounts & Presales

- Early access to major QVC events and holiday sales.

- Personalized promotions and birthday deals.

- Limited-time coupons available only to cardholders.

4. No Annual Fee

- Use your QVC credit card as often as you like without extra ongoing cost.

- All perks and rewards have no fee just for having the card.

5. Dedicated Customer Support

- Access to a cardholder-only customer service line.

- Faster response and specialized help for billing, orders, and QCard questions.

6. Online Account Management

- 24/7 access to statements, payment history, reward tracking, and promotional offers.

- Set up reminders or automate your minimum payments.

7. Security and Peace of Mind

- Zero liability fraud protection.

- Synchrony Bank’s secure payment networks.

8. Build or Boost Your Credit (When Used Responsibly)

- Timely payments may improve your credit profile.

- A positive payment history is reported to credit bureaus.

<a id=”section3″></a>

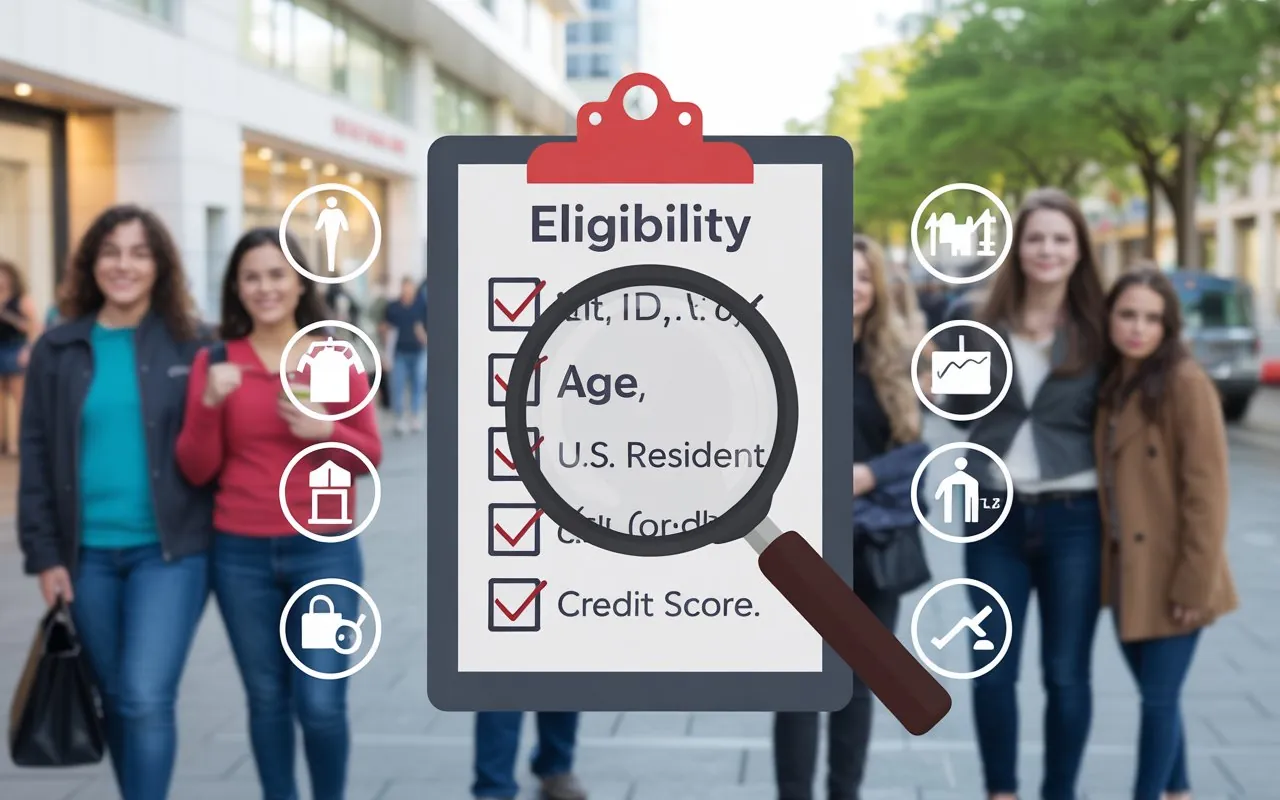

Who Should Apply: Eligibility, Criteria, and Things to Know

Not sure if you qualify to apply for the QVC credit card? Let’s cover all eligibility requirements and practical considerations in detail.

Basic Application Requirements

You’ll need:

- Age: Must be at least 18 years old (or 21 in some U.S. states)

- Residency: Must be a legal resident of the United States (QCard is not currently available for international/non-U.S. residents; see alternatives below)

- Identification: Valid government-issued photo ID (driver’s license, passport, state ID)

- SSN or Taxpayer ID: For identity verification and credit check

- Credit History: Recommended FICO score: 640 or above (some approvals for lower scores, but with lower limits or higher interest rates)

Note for International Shoppers:

Shoppers outside the U.S. can still purchase from QVC using PayPal, Visa/Mastercard, or other accepted global payment methods—but the QCard is currently U.S.-only.

Soft vs. Hard Credit Inquiry

- Applying for the QVC credit card will usually require a hard inquiry on your credit report.

- This may slightly lower your credit score temporarily, as with any new credit application.

Who Should Consider the QVC QCard?

Ideal for:

- Frequent QVC shoppers (weekly or monthly)

- Those who want to finance purchases over time

- People looking for member-only events, discounts, and flexible payment perks

- Individuals comfortable managing another credit line responsibly

<a id=”section4″></a>

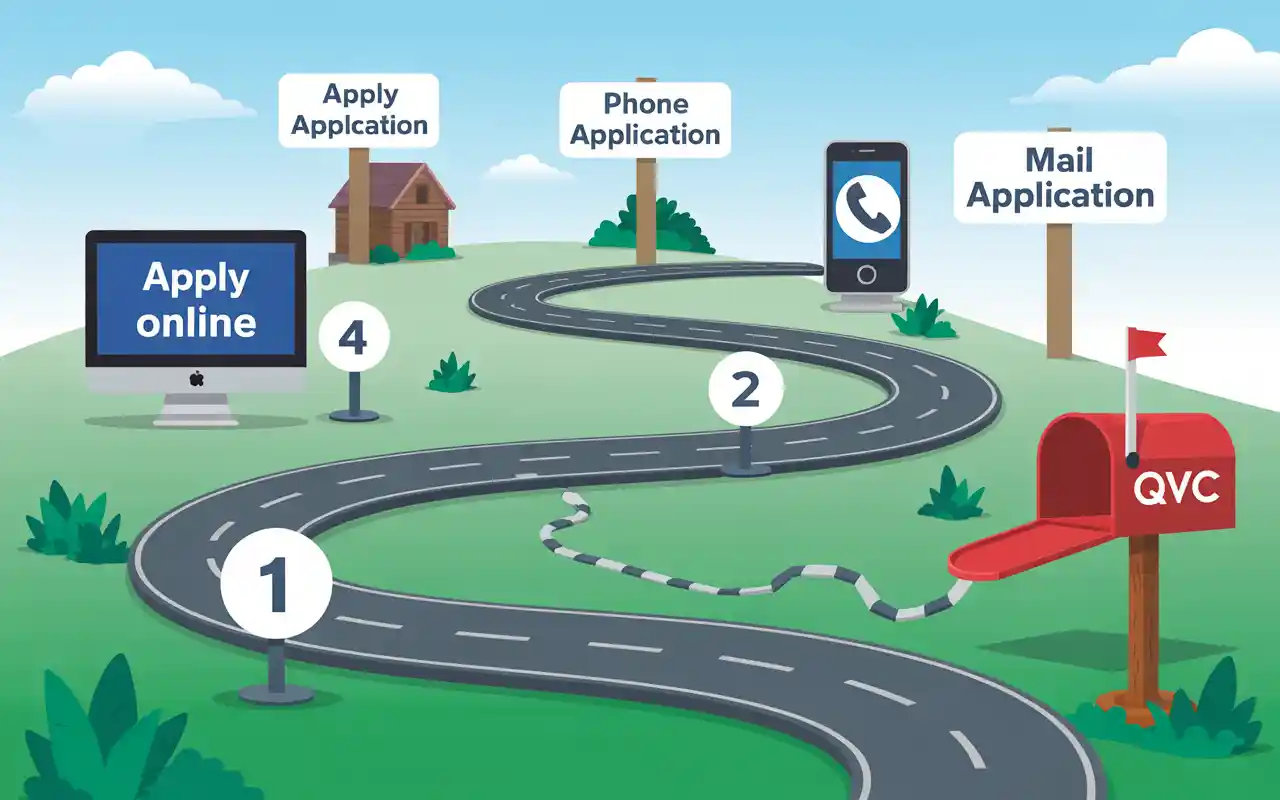

How to Apply for QVC Credit Card: Step-by-Step Methods

Let’s get practical! Here’s how to apply for QVC credit card accounts through any method, each explained in detail:

<a id=”section4a”></a>

How to Apply for QVC Credit Card Online

Detailed Step-by-Step Guide

- Navigate to QVC’s Official Website:

- Go to Qvc.com

- Scroll to the bottom and select “QCard” or search “QVC credit card” in the search bar.

- Start Your Application:

- Click on the “Apply Now” or “Learn More” button, which redirects to the Synchrony Bank application portal.

- Complete the Application Form:

- Input your full legal name, birthdate, U.S. address, email, and phone number.

- Enter your Social Security Number or Taxpayer Identification Number.

- Disclose your annual income and housing status (owner/renter).

- Review Terms and Disclosures:

- Carefully read the interest rates, fees, promotional offers, and terms—it’s important to understand potential costs.

- Consent and Submit:

- Agree to the legal terms.

- Submit your application securely online.

- Wait for Decision:

- Most applicants receive an instant decision.

- Some may need further review—watch your email and phone for updates within a few business days.

- Set up Online Account:

- If approved, log in to or create a Synchrony account for online management.

- You’ll receive your card in the mail (typically 7-10 days in the U.S.).

Visual Example

Emily, a Texas resident who shops from QVC monthly, inputs her details on the QVC site, reviews the APR details, and gets instant approval. She sets up online access the same day and is ready for the next “Christmas in July” sale!

<a id=”section4b”></a>

How to Apply for QVC Credit Card by Phone

Prefer speaking to someone? No problem.

Phone Application Process

- Call the QCard Application Line: 1-877-490-1787

- Prepare:

- Have your ID and Social Security Number ready.

- Be prepared to answer questions about your income and address.

- A representative will walk you through disclosures, explain terms, and complete your application verbally.

- You’ll get a decision over the phone or through follow-up mail/email.

International Note

- U.S.-based applicants only; international phone applications are not supported for the QCard.

<a id=”section4c”></a>

Apply by Mail: Traditional but Effective

- Download the printable application form from QVC.com.

- Carefully fill out every section—don’t leave any fields blank.

- Attach a copy of required documents (as requested).

- Mail your fully completed form to the Synchrony Bank address listed on the form.

Processing time is usually 10-14 business days after receipt.

<a id=”section5″></a>

Application Troubleshooting: Common Issues and Fast Solutions

Key Issues and What to Do

- Pending or Delayed Application:

- Make sure contact info is accurate and watch all email folders.

- Follow up via QVC’s customer support or Synchrony Bank if no status update within 7 business days.

- Declined Application:

- Synchrony is required to send a letter outlining the primary reason (low credit, incorrect info, existing account, etc.)

- If declined, check your credit report for errors, settle outstanding debts, and apply again after 6 months.

- Technical Glitches (Online):

- Try a different browser or device.

- If issues persist, apply by phone.

- Credit Freeze:

- If you have a freeze on your credit bureau profiles, you’ll need to temporarily lift it for the QVC credit card application.

- Security Check or Additional Documents Needed:

- Respond to requests quickly to avoid cancellation.

- International Issue:

- QCard is only available to U.S. residents. Use alternative payments if you are shopping internationally.

Hot Tip:

Be proactive—double-check information, have documents ready, and keep an eye on your communication channels for follow-up.

<a id=”section6″></a>

Real-World Scenarios: Practical Examples and Success Stories

The Frequent Shopper

Janet, a QVC “super fan” from Ohio, applies online. She splits a $600 cookware set into 5 Easy Pay installments—no extra fees or interest thanks to a special financing promo. With her QVC credit card, Janet gets an early invite to the QVC Spring Sale and uses a members-only coupon for an extra 20% off her next fashion splurge.

The Holiday Gifter

Michael, who shops QVC mainly for holiday gifts, opens a QCard before Black Friday after seeing a promo for new cardholders (a $40 statement credit after his first QCard purchase). He schedules automatic payments, keeps his balance at $0, and makes the most of yearly QVC-deals.

The Credit Rebuilder

Patrice has a fair credit score. She’s approved with a modest initial QCard limit. By making small monthly purchases and paying them off every cycle, she sees her Synchrony-issued QCard help boost her FICO score over a year.

<a id=”section7″></a>

After Submitting Your QVC Credit Card Application: What Happens Next?

Approval Process

- Instant decisions are common—look for an email or phone call confirmation.

- Further review: If more info is needed, you’ll be contacted (be sure your contact info is valid and up-to-date).

Receiving Your Card

- Shipped to your U.S. address within 7–10 business days.

- Activate it via phone or online once it arrives.

First-time Cardholder Bonus

- Occasionally, QVC offers a sign-up bonus. Example: “Spend $50 on your QCard in the first month, get $20 statement credit.”

Setting Up Online Account Management

- Log into your Qvc account or Synchrony’s QCard portal.

- Activate autopay, set reminders, and start tracking your rewards.

<a id=”section8″></a>

Managing Your QVC Credit Card Online and in the Real World

Online Account Tools

- Access your balance, recent transactions, payment due dates, statements, and promotional offers instantly.

- Pay your bill using a checking account, debit card, or schedule recurring payments.

Payment Methods

- Online: via QVC.com or Synchrony’s customer portal.

- By Phone: Secure payments through automated or live agent support.

- By Mail: Send a check/money order to the payment address listed on your statement (allow time for postal delivery).

Viewing and Redeeming Perks

- Log in monthly to check for new deals—birthday gifts, flash sales, and promo codes available to cardholders.

Staying Secure

- Enable alerts for purchases, statement availability, or suspicious activity.

- Report lost/stolen cards immediately for fast resolution.

<a id=”section9″></a>

Alternatives: QVC Credit Card vs. Other Shopping and Payment Options

Other Ways to Pay at QVC

- Visa, Mastercard, Amex: All major cards accepted.

- PayPal: Secure, fast, and suitable for international orders.

- Debit Cards: VISA and Mastercard-branded cards supported.

- Gift Cards/Prepaid: QVC’s own or accepted branded gift cards.

Comparing QVC Credit Card to Other Store Cards

| Feature | QVC QCard | Amazon Store Card | Best Buy Credit Card | Target RedCard |

|---|---|---|---|---|

| Use Location | QVC + partners | Amazon only | Best Buy (+ partners) | Target (+ online) |

| Financing Offers | Yes | Yes | Yes | No |

| Annual Fee | None | None | None | None |

| Special Discounts | Yes | Yes | Yes | 5% cash back |

Choose the store-branded card that matches your primary shopping and payment goals.

<a id=”section11″></a>

Pro Tips: Maximize Your QVC Experience

Get the Most from Your QVC Credit Card

- Set Up Autopay: Avoid late fees by scheduling payments automatically.

- Track Your Promo Expiry Dates: Don’t let “Easy Pay” or 0% APR deals expire with a balance—pay off principal before deadlines.

- Shop Sales Events: Use QCard perks in conjunction with QVC’s biggest annual sales for maximum savings.

- Download the QVC App: Manage your account, track shipping, and access member-only quick fixes right from your phone.

- Keep Credit Utilization Low: Aim to use less than 30% of your QCard limit to maximize credit score benefits.

- Refer a Friend: Watch for refer-a-friend weeks—bonus credits or coupons may be available for helping a friend sign up.

<a id=”section12″></a>

Is the QVC Credit Card Right for You? A Final Checklist

Consider a QVC QCard if you:

- Shop at QVC multiple times a year

- Want installment/payment flexibility (Easy Pay)

- Love exclusive member deals and presale access

- Are confident about paying balances in full to avoid interest

- Want to manage your budget with predictable payments

It may not be your best choice if you:

- Rarely shop at QVC/HSN/Zulily

- Prefer cash or PayPal for online shopping

- Don’t want any new inquiries or accounts on your credit report

- Live outside the United States

<a id=”section13″></a>

Related Variations and Keywords Used in This Guide

- How do I apply for QVC credit card online?

- QVC credit card application process

- QCard payment flexibility

- Sign up for QVC store credit card

- QVC Easy Pay installment card

- QVC QCard eligibility 2025

- Apply and activate QVC credit card

Frequently Asked Questions: In-Depth QVC QCard Q&A

1. What credit score do I need to get a QVC credit card?

- Most cardholders get approved with a minimum FICO score of 640. Lower scores may still be considered, but can result in a smaller initial credit limit or a higher APR.

2. Is there an annual or monthly fee for the QVC credit card?

- No annual fee, no monthly fee—simply pay off your purchases on time.

3. Where can I use my QVC credit card?

- QVC.com, QVC TV/app purchases, and most Zulily and HSN orders (check each partner site’s eligibility).

4. How does QVC’s “Easy Pay” differ from regular payments?

- “Easy Pay” is QVC’s version of installment plans; split the total price into multiple payments over months, interest-free from QVC (though your credit card’s standard rates apply if not paid fully by due date).

5. Can I use my QCard for balance transfers or cash advances?

- No—QVC QCard is only for purchases at QVC, HSN, and affiliate brands; no cash withdrawals or transfers.

6. What happens if my application is declined?

- Synchrony Bank will provide a written reason. Address any credit report issues before reapplying in the future.

<a id=”section10″></a>

Conclusion

Learning how to apply for QVC credit card accounts opens the door to a more flexible, rewarding shopping journey—if you’re a committed QVC, HSN, or Zulily enthusiast. The QCard application process is straightforward and can be done online, by phone, or through the mail in the United States. You’ll enjoy member-exclusive offers, flexible ways to pay, and the security of Synchrony Bank—all with no annual fee.