Selecting the best insurance broker in Ontario is one of the most important financial decisions you can make—yet it’s a choice many people approach without enough information, context, or clarity. Ontario’s insurance market is not only vast, with countless brokerages and policy options, but also highly regulated and constantly evolving. For homeowners, drivers, business owners, and families, having an experienced broker in your corner goes far beyond simply purchasing a policy or comparing prices. It’s about building a relationship with someone who truly understands your unique needs, the specific risks you face in Ontario, and the protection required to confidently move forward in life.

The best insurance broker in Ontario serves as your trusted guide through a sea of complex choices and confusing jargon. Instead of leaving you to sift through dozens of competing insurers or decipher complicated terms on your own, a skilled broker does the heavy lifting—researching coverage options, negotiating on your behalf, and ensuring your interests always come first. As the pace of change accelerates, new risks, such as severe weather events, rising property values, cyber threats, and evolving legal requirements, demand tailored insurance solutions that are current and flexible. The right broker doesn’t just react to these changes but anticipates them, proactively recommending adjustments and new protections to keep you a step ahead.

Navigating the insurance landscape in Ontario without guidance can lead to costly mistakes, missed opportunities for savings, or inadequate coverage when you need it most. By partnering with a leading Ontario insurance broker, you unlock access to deep local expertise, a broad network of insurers, and an advocate who stands by you at every stage—from needs assessment to claims support and annual reviews. This commitment to ongoing education, market awareness, and client-centered service is what truly sets the top professionals apart and ensures you’re always protected, no matter how life changes.

Why the Best Insurance Broker in Ontario Makes All the Difference

The insurance broker landscape in Ontario is crowded and competitive. Rates, coverage, and customer experience can vary widely. That’s why the best insurance broker in Ontario is distinguished by:

- Local expertise: Understanding of regional risks like Ontario’s floodplains, snow and ice, urban density, and rural property concerns.

- Wide market access: Providing quotes from dozens of insurers, from large household names to boutique specialists.

- Client-first approach: Advocating for you—not the insurance company—through every phase, from policy selection to claims settlement.

- Ongoing support: Regular check-ins, annual coverage reviews, and proactive advice as your needs evolve.

People who use a top Ontario insurance broker routinely report better coverage at a lower net cost, along with a much smoother, less stressful insurance experience.

Core Qualities of the Best Insurance Broker in Ontario

Knowledge and Licensing

The best brokers hold a valid, up-to-date license with the Registered Insurance Brokers of Ontario (RIBO). They’re also:

- Trained in the latest provincial insurance law, claims protocols, and underwriting practices.

- Required to maintain continuing education, keeping them ready to advise on emerging risks and new financial products.

Product Breadth and Customization

They don’t just offer one-size-fits-all insurance. Expect a full suite of options:

- Home, auto, condo, rental, and cottage policies.

- Small business and commercial insurance for liability, property, commercial vehicles, and inventory.

- Specialty coverage: cyber, environmental, event, farm, and construction risk.

- Life and critical illness products, tailored to families, professionals, and small business owners.

Transparency and Education

A top broker explains policy terms, exclusions, limits, and add-ons in plain language. They’ll provide sample scenarios, so you truly understand what you are—and aren’t—protected against.

Personal Insurance Solutions from Ontario’s Best Brokers

Homeowners and Condo Insurance

Ontario homes face climate-specific risks: bursting pipes in winter, basement flooding, wind and hail storms. A strong broker will help you:

- Understand available add-ons like sewer backup, overland flood, and identity theft.

- Determine the right replacement value for your building and contents.

- Balance your deductible against monthly premiums for optimal affordability.

Auto Insurance

Ontario’s auto market is regulated, but costs and options still differ. The best brokers:

- Shop multiple companies to get you better savings, regardless of driving history.

- Identify added protections like accident forgiveness or rental vehicle coverage.

- Advise rideshare drivers (Uber, Lyft) on commercial requirements.

Tenant & Rental Insurance

Renters are often underinsured. Brokers educate tenants on required personal property coverage and liability risks, helping to avoid common claim denials.

Vacation and Cottage Coverage

Specialist advice is vital for secondary properties: are there restrictions if your cottage is vacant, rented on Airbnb, or in a flood zone? The best brokers have answers and solutions.

Commercial and Specialty Insurance Services

Small Business Owners

Businesses see the most dramatic benefit from independent, expert broker advice in Ontario:

- Identify unique exposures: professional liability, product recall, cyberattack, and more.

- Ensure that inventory, equipment, and intellectual property are properly valued.

- Find group plans that help business owners cover employees and their families with health, dental, and life options.

Professional Practices

Lawyers, healthcare professionals, consultants, and IT providers all need custom liability insurance. Brokers compare errors & omissions products designed for your sector, protecting your reputation and assets.

Contractors and Trades

Ontario’s building and trades industries have specific needs: tools, vehicles, worksites, builder’s risk, and surety bonds. An experienced broker prevents coverage gaps that could stall projects or increase out-of-pocket losses.

Community and Non-Profit Organizations

Best insurance brokers in Ontario work with local charities, associations, and arts groups, ensuring liability, event, and directors’ coverages are in place for risk-free operations.

Life, Health, and Family Protection

Life Insurance

- Term life for mortgage and family protection—affordable for young professionals.

- Permanent and universal life for estate planning, investment, and charitable giving.

- Critical illness and disability for recovery and income replacement when emergencies happen.

Group Benefits for Businesses

Brokers organize competitive group health, dental, vision, and wellness packages—essential for small-to-mid-sized employers looking to retain top talent in Ontario’s competitive workforce.

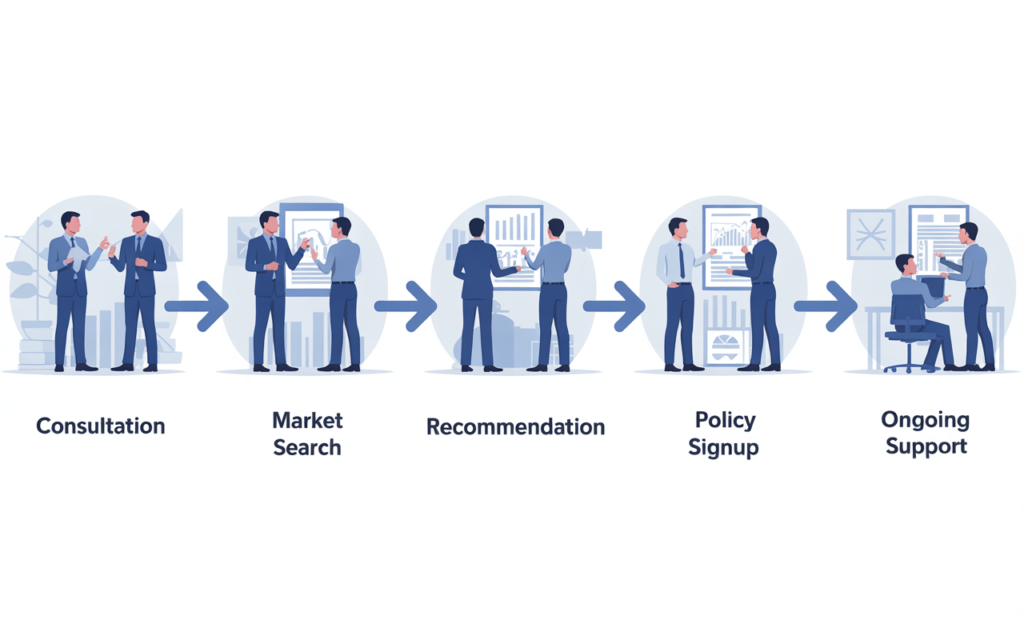

How Ontario’s Top Brokers Work: The Process, Step by Step

1. Discovery and Risk Assessment

Your broker begins by:

- Evaluating every aspect of your risk profile (home features, business operations, driving record, family status, etc.).

- Gathering claims history, property values, and any unique exposures.

2. Market Search

They cast a wide net, obtaining quotes and underwriting feedback from local, national, and specialty insurers—often identifying niche products unavailable directly.

3. Coverage Recommendations

You’ll receive not just one, but several customized options, each explained with:

- Pros, cons, and sample claim scenarios.

- Precise policy limits, exclusions, and endorsement recommendations.

- Honest advice, not sales pressure.

4. Implementation and Onboarding

Brokers guide you through every form, prompt you for necessary documentation, and ensure your new coverage aligns with legal timelines (important for homebuyers awaiting closing, or businesses signing new leases).

5. Ongoing Policy Management

The best insurance broker in Ontario doesn’t go silent after the sale:

- Annual policy reviews and realignment (so you’re never over- or under-insured).

- Claims support: clarification, documentation, and negotiation.

- Updates as new risks, regulations, or better products become available.

Common Pitfalls Brokers Help You Avoid

- Underinsuring contents or assets due to outdated estimates or missed renovations.

- Failing to disclose new drivers or property uses, leading to claim denials.

- Overpaying for unnecessary extras or duplicate coverage.

- Missing out on discounts like multi-policy, claims-free, alarm, association, or loyalty incentives.

Real-World Scenarios—How the Best Brokers Deliver Value

A Toronto homeowner’s basement floods during a summer thunderstorm. Their broker, anticipating increased regional flooding, added an endorsement six months prior—the insurance covers full cleanup and repairs, saving the family $35,000.

A small tech startup in Waterloo realizes that its modest business insurance does not include cyber liability. Their broker spots the gap, adds cybercrime protection, and a month later, a hacking incident leads to a $40,000 data recovery claim that’s fully paid by the insurer.

A retiree in Kingston is about to sell his home and move into a condo. His broker not only arranges seamless property and condo insurance transitions but uses the opportunity to restructure liability coverage, lowering total annual costs by 28%.

Tips for Getting the Most Out of Your Ontario Insurance Broker

- Ask for a complete market comparison, not just their top three providers.

- Check for digital access: Can you manage policies online? Get help after hours?

- Don’t hesitate to ask basic questions: No inquiry is too small—coverages, claims, payments, or discounts.

- Keep your broker updated: New drivers, purchases, renovations, or business changes should be shared promptly to avoid coverage gaps.

- Review deductibles: Sometimes a slightly higher deductible can lower premiums substantially without much additional risk.

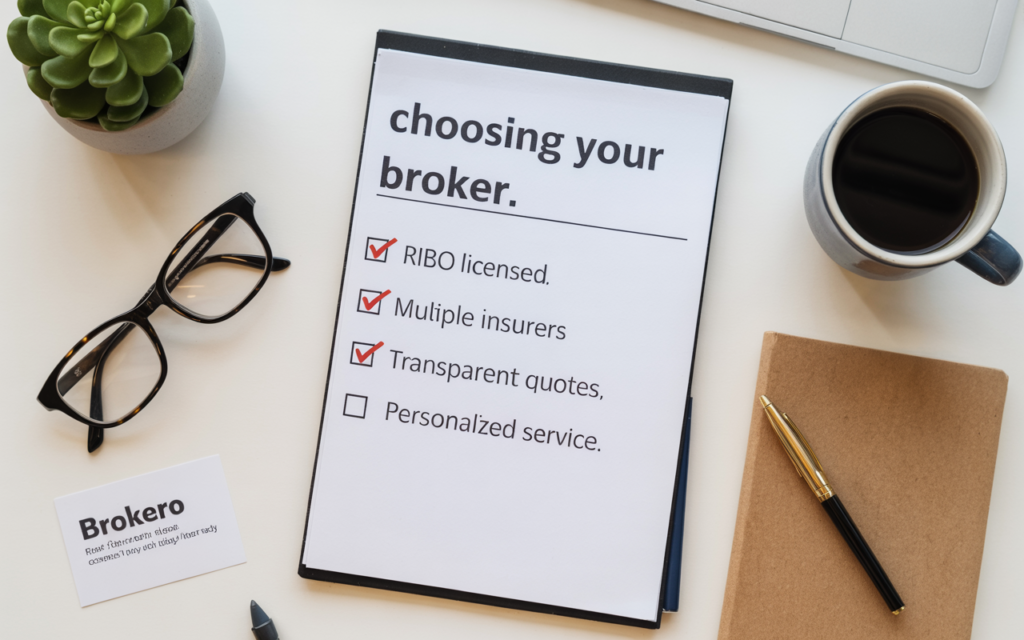

Choosing the Best Insurance Broker in Ontario: A Step-by-Step Checklist

- Define your current and forecasted needs for coverage.

- Seek out only RIBO-licensed professionals or firms.

- Shortlist several brokers and compare responsiveness, carriers, and specializations.

- Request plain-language, apples-to-apples quotes.

- Confirm ongoing service offerings (annual reviews, claims help, policy updates).

- Make your final choice based on trust, clarity, and service—never just cheapest price.

Frequently Asked Questions

Do brokers charge extra fees?

For standard personal and small business insurance, brokers are generally paid commissions by insurers, not by clients. This means their services rarely cost you more—and often save you money in the long run.

Can I switch brokers while keeping my insurance company?

In most cases, yes. Your new broker will handle the paperwork. Some insurers have restrictions, so ask in advance.

How can a broker help at claim time?

They clarify what’s covered, ensure all paperwork is correct, and negotiate with the insurer if your initial payout is low or challenged.

How many insurers should a top broker have access to?

Typically 10–30+ for robust personal and commercial market access, ensuring you get the best policy.

What’s the difference between a broker and an agent?

Brokers work independently, shopping the entire market. Agents represent one insurer and only sell their policies.

conclusion

Partnering with the best insurance broker in Ontario isn’t just a financial transaction—it’s forging a relationship with a dedicated risk advisor. In a world of shifting risks, complex regulations, and fast-changing lifestyles, your broker’s expertise, advocacy, and support are invaluable. Invest in finding the right partner now, and enjoy lasting peace of mind—for yourself, your family, and your business.