Embarking on a journey toward financial security is one of the most empowering decisions a person can make. It often begins with the exciting process of setting goals—dreaming of a comfortable retirement, a new home, or freedom from debt. But a dream without a roadmap is just a wish. While setting goals is the essential first step, many people falter because they don’t know what comes next. This leads to the pivotal question: what is the second key of a successful financial plan? This second element is the engine that drives your plan forward, turning abstract goals into tangible reality.

This guide is dedicated to thoroughly exploring that crucial next step. We will move beyond the “what” and delve into the “how,” providing a blueprint for building a resilient and effective financial strategy. The answer to what is the second key of a successful financial plan is not a secret formula, but a foundational practice that underpins all financial success. It is the bridge between where you are now and where you want to be. Understanding and implementing this key is what separates those who dream about financial freedom from those who achieve it.

The Foundation: Understanding the First Key to Set the Stage

Before we can fully appreciate the answer to what is the second key of a successful financial plan, we must first acknowledge its predecessor. The first key of any successful financial plan is setting clear, specific, and measurable financial goals. Without a clear destination, any map is useless.

Your financial goals are the “why” behind your plan. They provide motivation and direction. These goals can be:

- Short-term: Such as building an emergency fund of three to six months’ worth of living expenses within the next year.

- Mid-term: Like saving for a down payment on a house within the next five years.

- Long-term: For example, accumulating enough capital to retire comfortably in 25 years.

These goals must be specific. “I want to save more money” is a wish, not a goal. “I will save $5,000 for a down payment by December 31st of next year” is a goal. It is measurable, specific, and time-bound. This clarity is the essential starting point. But once you have this destination in mind, you need a vehicle to get you there. This brings us directly to the central topic: what is the second key of a successful financial plan?

The Engine of Your Plan: What is the Second Key of a Successful Financial Plan?

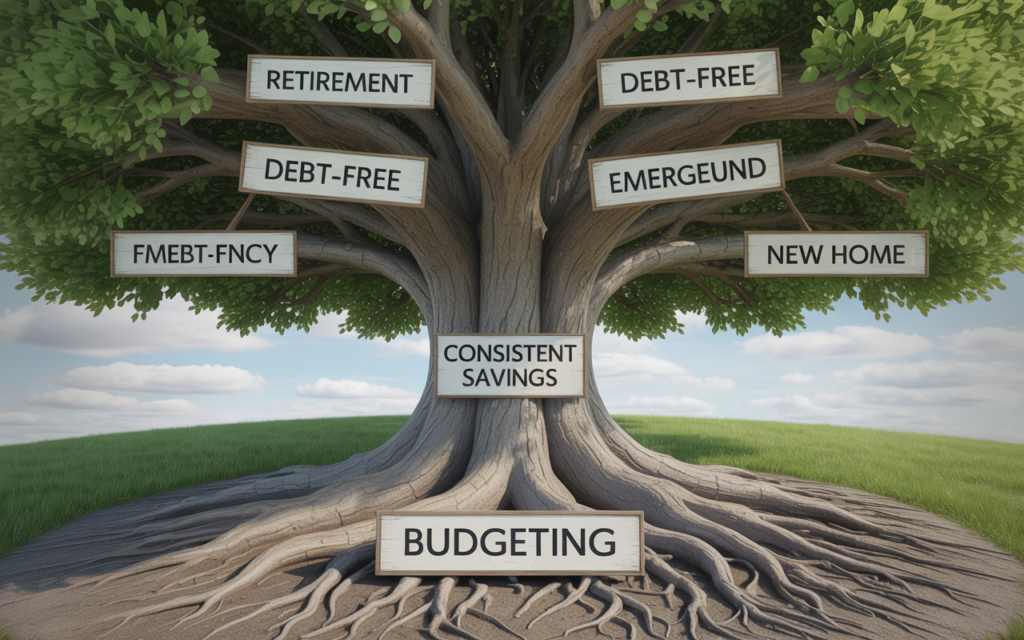

The second key of a successful financial plan, the element that activates your goals and puts them in motion, is creating and maintaining a realistic budget. A budget is, quite simply, a detailed plan that outlines how you will manage your income and expenses over a specific period. It is the operational blueprint of your financial life.

If your financial goal is the destination, your budget is the GPS navigation system that provides turn-by-turn directions to get you there. It tells you where your money is coming from, where it is going, and, most importantly, how you can intentionally direct it toward the things that matter most to you—your goals.

Many people hear the word “budget” and think of restriction, deprivation, and cutting out all the fun from their lives. But this is a fundamental misunderstanding. A good budget is not about restriction; it’s about empowerment and intention. It is a tool that gives you control over your money, rather than letting your money control you. The answer to what is the second key of a successful financial plan is about gaining this control. Understanding that a budget is a tool for freedom is the correct way to think about what is the second key of a successful financial plan.

This second key is so critical because it provides:

- Clarity: It gives you a crystal-clear picture of your financial reality.

- Control: It allows you to make conscious decisions about your spending.

- Efficiency: It helps you identify and eliminate wasteful spending, freeing up cash for your goals.

- Accountability: It provides a benchmark to measure your progress against.

Without a budget, your financial plan is built on guesswork. You might have a goal to save $500 a month, but if you don’t know where that $500 will come from, it’s unlikely to happen consistently. This is why when we ask what is the second key of a successful financial plan, the answer must be a system for managing cash flow. The entire inquiry of what is the second key of a successful financial plan is answered by this principle of intentional money management.

Building Your Budget: The Practical Application of the Second Key

Now that we’ve identified the answer to what is the second key of a successful financial plan, let’s break down how to put it into practice. Creating a budget involves a few straightforward steps.

Step 1: Track Your Income and Expenses

The first step in creating a budget is to understand your current financial situation. You need to know exactly how much money you have coming in and where it is going.

- Calculate Your Total Monthly Income: This includes your net pay (after taxes and deductions), as well as any income from side hustles, investments, or other sources.

- Track Every Single Expense: For at least one month, track everything you spend money on. You can do this using a dedicated budgeting app, a simple spreadsheet, or even a notebook. Be meticulous. Every coffee, subscription, and grocery run counts.

This tracking phase is often eye-opening. Most people are shocked to see how much they are spending on non-essential items. This data is the raw material you will use to build your budget. This is the foundational work required by what is the second key of a successful financial plan.

Step 2: Categorize Your Expenses and Analyze Your Spending

Once you have a month’s worth of data, it’s time to categorize your expenses. This will help you see where your money is truly going. Common categories include:

- Fixed Expenses: These are costs that stay the same each month, such as rent/mortgage, car payments, and insurance premiums.

- Variable Expenses: These are costs that change from month to month, like groceries, gasoline, and utilities.

- Discretionary Expenses (Wants): This category includes non-essential spending, such as dining out, entertainment, and shopping.

After categorizing, analyze your spending. Are you happy with where your money is going? Does your spending align with your values and your long-term goals? This analysis is a core component of what is the second key of a successful financial plan.

Step 3: Create Your Budgetary Plan

Now, it’s time to create your forward-looking budget. A popular and effective method is the 50/30/20 rule, which provides a simple framework:

- 50% for Needs: Allocate up to 50% of your after-tax income to your essential needs (fixed and variable expenses like housing, transportation, and groceries).

- 30% for Wants: Allocate up to 30% of your income to your discretionary spending.

- 20% for Savings and Debt Repayment: Allocate at least 20% of your income toward your financial goals, such as building your emergency fund, saving for retirement, and paying off high-interest debt.

This is just a guideline. You can adjust the percentages to fit your unique situation. The important thing is to create a plan where every dollar of your income is assigned a job. This is the essence of what is the second key of a successful financial plan.

Sticking to Your Budget: Making the Second Key a Sustainable Habit

Creating a budget is one thing; sticking to it is another. The real power of what is the second key of a successful financial plan lies in its consistent application. Here are some strategies to make your budget a sustainable habit.

Automate Your Finances

Automation is your best friend when it comes to sticking to a financial plan. Set up automatic transfers from your checking account to your savings and investment accounts on payday. This “pay yourself first” strategy ensures that you are consistently working toward your goals without having to rely on willpower. Automating your bill payments can also help you avoid late fees and simplify your financial life. This is a powerful tactic for anyone trying to implement the answer to what is the second key of a successful financial plan.

Use the Right Tools

There are countless tools available to help you manage your budget.

- Budgeting Apps: Apps can automatically track your spending, categorize your transactions, and show you your progress in real-time.

- The Envelope System: For those who prefer a more hands-on approach, the cash envelope system can be very effective. You allocate a specific amount of cash into labeled envelopes for different spending categories (e.g., “Groceries,” “Dining Out”). When the cash in an envelope is gone, you’re done spending in that category for the month. This makes overspending impossible. The method you use is less important than the consistency with which you use it. This is how you live out the answer to what is the second key of a successful financial plan.

Conduct Regular Check-ins

A budget is not a “set it and forget it” document. Your life, income, and expenses will change over time. It’s important to review your budget regularly, at least once a month, to ensure it is still working for you. These check-ins allow you to make adjustments, celebrate your progress, and stay motivated. This continuous improvement is a vital part of what is the second key of a successful financial plan. The discussion of what is the second key of a successful financial plan must include this element of review and adaptation.

How the Second Key Supports All Other Aspects of Financial Success

The reason that budgeting is the answer to what is the second key of a successful financial plan is that it is the foundational practice that makes everything else possible.

- Debt Management: A budget helps you identify extra cash that can be used to accelerate your debt repayment. By creating a debt snowball or avalanche plan within your budget, you can get out of debt faster and save money on interest.

- Saving and Investing: Your budget is what allows you to consistently allocate funds toward your savings and investment goals. It turns your desire to save into a concrete, repeatable action.

- Risk Management: A budget helps you plan for unexpected events. By including a line item for your emergency fund, you are building a financial cushion that can protect you from life’s curveballs without derailing your long-term plan.

- Retirement Planning: The massive, long-term goal of retirement can only be achieved through decades of consistent contributions. Your budget is the mechanism that ensures those contributions happen month after month, year after year.

In short, every other component of a sound financial plan relies on the cash flow management system that a budget provides. This is why what is the second key of a successful financial plan is such a critical question. The answer underpins everything else. Answering the question what is the second key of a successful financial plan correctly sets the stage for all future financial success. The principle behind what is the second key of a successful financial plan is about control.

The Final Word: The Power of Intentionality

In conclusion, after setting clear goals, the answer to what is the second key of a successful financial plan is the creation and consistent maintenance of a realistic budget. It is the practice of telling your money where to go, instead of wondering where it went.

A budget is not about what you can’t have; it’s about empowering you to achieve what you truly want. It’s the tool that aligns your daily spending habits with your long-term dreams. It provides the structure, discipline, and clarity needed to navigate your financial journey with confidence.

So, if you have your financial goals in place, your next step is clear. Embrace the power of the budget. Take the time to track, analyze, and plan. It may seem like a simple concept, but its impact is profound. The dedicated practice of budgeting is the definitive answer to what is the second key of a successful financial plan, and it is the single most powerful action you can take to build the financial future you deserve. The query what is the second key of a successful financial plan is ultimately a question about how to build a better life through financial control.