Your ability to earn an income is your most valuable asset. It is the engine that powers your entire financial life, paying for your home, your family’s needs, and your future dreams. But what happens if that engine suddenly stalls? An unexpected illness or a serious injury could leave you unable to work for months, or even years, putting everything you’ve worked for at risk. This is where disability income insurance becomes a crucial safety net. However, once you have this protection, a vital question arises: with disability income insurance benefits usually begin after you become disabled?

This comprehensive guide is designed to provide a clear and detailed answer to that critical question. The waiting period before you receive your first payment is one of the most misunderstood aspects of disability insurance, and this uncertainty can cause immense stress during an already difficult time. We will break down the timelines, explain the key terminology, and explore the factors that determine precisely when your financial support will start. Understanding the answer to with disability income insurance benefits usually begin is essential for creating a truly secure financial plan, ensuring you have the resources to bridge the gap and protect your family when you need it most.

What is Disability Income Insurance?

Before we explore the timeline, let’s first solidify our understanding of what this insurance does. Disability income insurance is a type of policy that provides you with a regular, monthly income if you are unable to work due to a disability resulting from an illness or injury. It is designed to replace a portion of your lost salary, typically ranging from 45% to 65% of your gross income, allowing you to continue paying your bills and maintaining your standard of living.

These policies come in two main forms:

- Short-Term Disability (STD) Insurance: This coverage is meant for temporary disabilities, providing benefits for a short period, usually from a few weeks up to six months.

- Long-Term Disability (LTD) Insurance: This coverage is for more serious, prolonged disabilities. The benefit period for LTD can last for several years, often up to age 65 or 67.

It is the gap between the day your disability starts and the day you receive your first check that this article will focus on. Understanding this gap is the key to knowing with disability income insurance benefits usually begin.

The Elimination Period: The Most Important Waiting Game

The single most important concept to understand when asking with disability income insurance benefits usually begin is the elimination period, also known as the waiting period.

The elimination period is a set amount of time that must pass from the date you are officially disabled until you are eligible to receive your first benefit payment. Think of it like a deductible on your car or health insurance, but measured in time instead of money. You must be continuously disabled throughout this entire period to qualify for benefits.

The purpose of the elimination period is to prevent claims for very short-term, minor illnesses. The length of the elimination period is a feature of the policy that you select when you purchase it. The choice you make has a direct impact on the cost of your insurance premium.

- Shorter Elimination Period (e.g., 30 days): Your benefits will start sooner, but your monthly premiums will be higher.

- Longer Elimination Period (e.g., 180 days): You will have to wait longer, but your monthly premiums will be significantly lower.

This trade-off between waiting time and premium cost is a central consideration. A critical part of your financial plan is deciding how long you could financially support yourself before with disability income insurance benefits usually begin. This is a fundamental aspect of knowing with disability income insurance benefits usually begin.

With disability income insurance benefits usually begin: Typical Timelines

So, let’s get to the specific numbers. The most common answer to the question of when with disability income insurance benefits usually begin is that they start after the chosen elimination period has been satisfied. These periods typically fall into a few standard options.

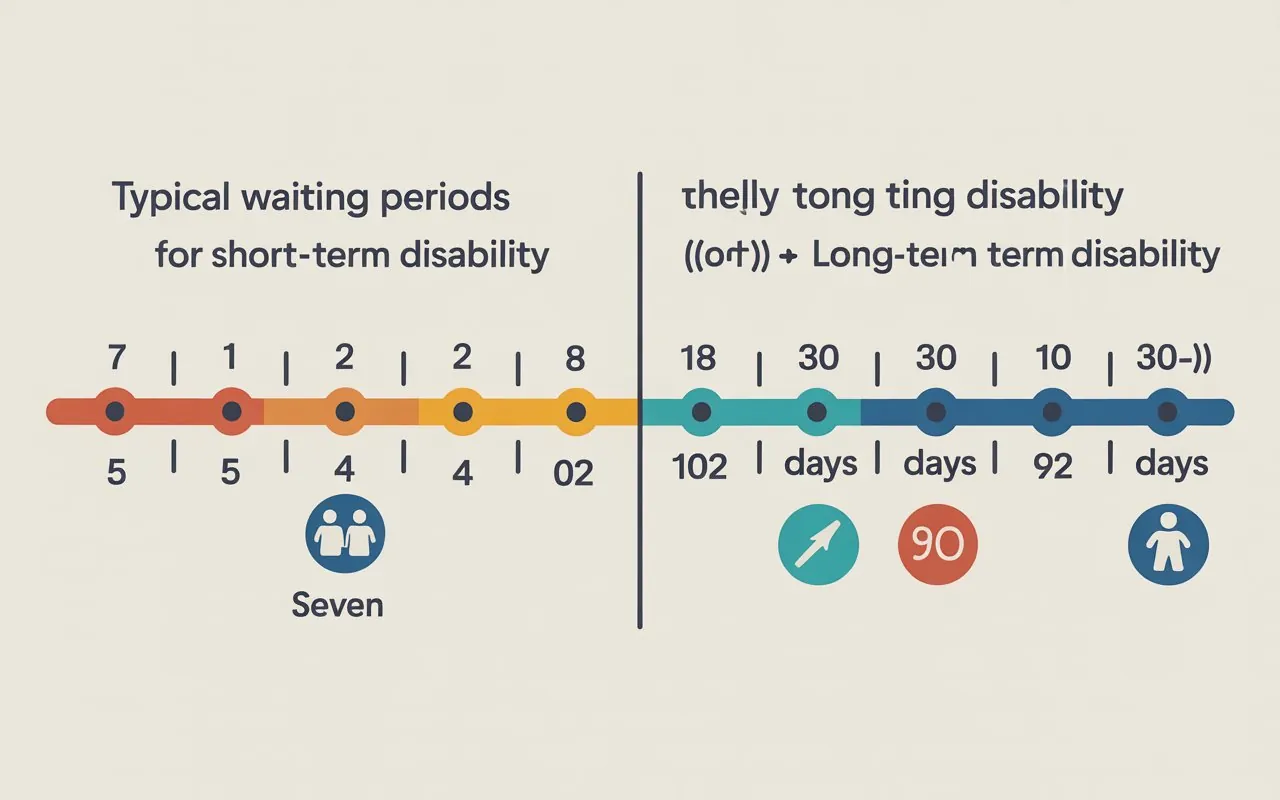

Short-Term Disability (STD) Timelines

Short-term disability policies are designed to kick in relatively quickly after a disability occurs. The elimination period for STD is usually very short. A common waiting period for STD is seven days. This means that after you become disabled, there is a non-payable waiting period of one week. Your first benefit payment would cover the period starting on the eighth day of your disability. The answer to with disability income insurance benefits usually begin for STD is much faster than for LTD.

Long-Term Disability (LTD) Timelines

Long-term disability policies have much longer elimination periods. This is because they are designed to work in concert with any short-term disability benefits or sick leave you might have.

The most common range of time for when with disability income insurance benefits usually begin on an LTD policy is between 30 and 90 days after the disability occurs.

The standard elimination period options you can typically choose from for an LTD policy are:

- 30 days

- 60 days

- 90 days

- 180 days

- 365 days or longer in some cases

A 90-day elimination period is a very popular choice. It provides a good balance between a manageable waiting time and an affordable premium. A person with a 90-day elimination period would need to be able to cover their living expenses for approximately three months before their LTD benefits would start. It is essential to understand that with disability income insurance benefits usually begin only after this substantial waiting period. This timeline is the most critical part of the answer to with disability income insurance benefits usually begin.

Government Disability Benefits (e.g., U.S. Social Security)

It’s also important to distinguish private insurance from government-provided benefits, as their timelines are very different. For Social Security Disability Insurance (SSDI) in the United States, there is a mandatory five full-month waiting period. The timeline for when with disability income insurance benefits usually begin under a government program is often much longer than with private insurance. This long wait underscores the importance of private coverage, as with disability income insurance benefits usually begin much sooner.

With disability income insurance benefits usually begin: The Claims Process

Knowing your elimination period is only one part of the equation. The actual start of your benefits is also dependent on the claims process itself. You can’t simply wait out the elimination period and expect a check to arrive. You must proactively file a claim and have it approved. The efficiency of this process will influence when with disability income insurance benefits usually begin.

1. Notifying the Insurance Company

The first step is to notify your insurance agent or company as soon as you become disabled. Do not wait until your elimination period is over to do this. The clock on your elimination period starts on the date of your disability, but the clock on the insurance company’s review process doesn’t start until they receive your claim.

2. Filing the Claim

Filing a disability claim involves a significant amount of paperwork. You will typically need to provide:

- A Claimant’s Statement: Your detailed account of your disability.

- An Attending Physician’s Statement (APS): A form completed by your doctor.

- An Employer’s Statement: A form completed by your employer.

The time it takes to gather these documents and submit them can affect when with disability income insurance benefits usually begin.

3. The Review and Approval Process

Once the insurance company receives your completed claim, their team will review all the documentation. This review process can take several weeks. If your claim is approved, the insurance company will notify you, and your benefits will be scheduled to begin after your elimination period is complete. The fact that the claims process runs concurrently with the waiting period is a key detail in understanding when with disability income insurance benefits usually begin. You must remember that with disability income insurance benefits usually begin only after both the elimination period and the claim approval are complete. This reality is crucial when considering with disability income insurance benefits usually begin.

How to Prepare for the Waiting Period

Since you now know that with disability income insurance benefits usually begin after a significant delay, proactive financial planning is essential. You must have a plan to cover your expenses during the elimination period. Your preparation will determine your stability during the wait before with disability income insurance benefits usually begin.

Build a Robust Emergency Fund

Your emergency fund is your primary line of defense. Financial experts typically recommend having 3 to 6 months’ worth of essential living expenses saved. When choosing your elimination period, you should ensure that your emergency fund can comfortably cover that entire duration.

Coordinate with Other Benefits

If you have short-term disability coverage through your employer, make sure you understand how it coordinates with your long-term disability policy. Often, an LTD policy with a 180-day elimination period is designed to begin just as a six-month STD policy ends. Understanding this coordination is key to knowing precisely with disability income insurance benefits usually begin for your long-term needs.

Plan for a Reduction in Income

Remember that disability insurance typically replaces only 45-65% of your income. During your waiting period, it’s wise to review your budget and identify non-essential expenses you can cut. This practice will also prepare you for living on a reduced income once the benefits start.

Conclusion: Planning for Peace of Mind

The question—with disability income insurance benefits usually begin?—is one of the most practical and important questions an insured person can ask. The answer is not immediate. It is after a contractually agreed-upon waiting period, known as the elimination period, which for long-term policies is most commonly between 30 and 90 days. This means that with disability income insurance benefits usually begin after a considerable waiting period.

This built-in delay is a fundamental feature of disability insurance. However, it places the responsibility squarely on you, the policyholder, to be prepared. This preparation involves choosing an elimination period that aligns with your financial reality and building an emergency fund that can cover that waiting period. By taking the time to understand the answer to with disability income insurance benefits usually begin, you transform a period of uncertainty into a manageable, predictable part of your financial plan.